Authors

Summary

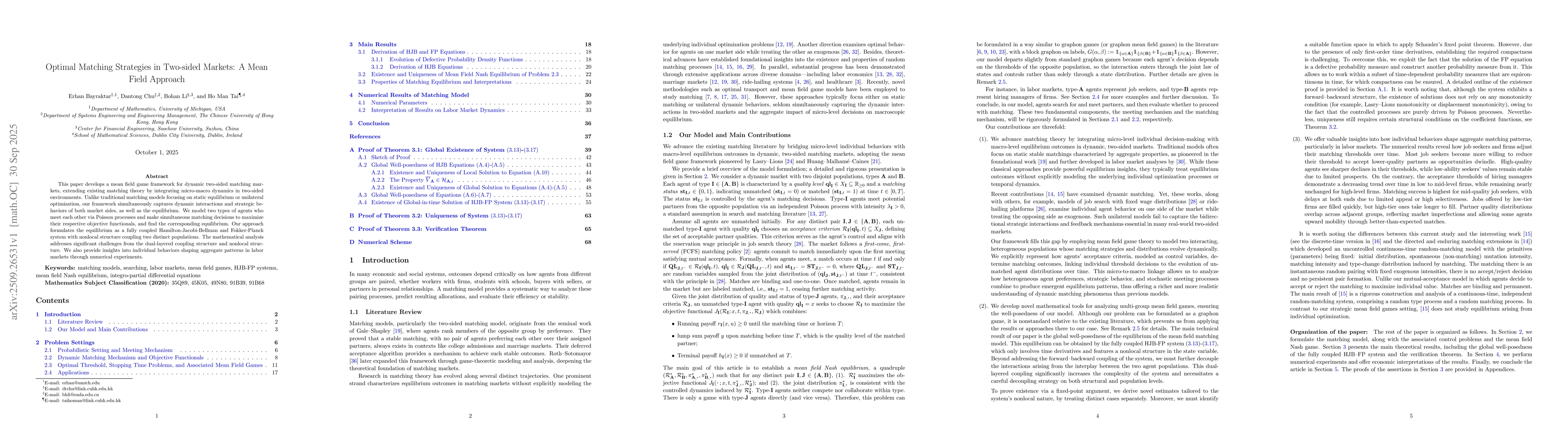

This paper develops a mean field game framework for dynamic two-sided matching markets, extending existing matching theory by integrating micro-macro dynamics in two-sided environments. Unlike traditional matching models focusing on static equilibrium or unilateral optimization, our framework simultaneously captures dynamic interactions and strategic behaviors of both market sides, as well as the equilibrium. We model two types of agents who meet each other via Poisson processes and make simultaneous matching decisions to maximize their respective objective functionals, and find the corresponding equilibrium. Our approach formulates the equilibrium as a fully coupled Hamilton-Jacobi-Bellman and Fokker-Planck system with nonlocal structure coupling two distinct populations. The mathematical analysis addresses significant challenges from the dual-layered coupling structure and nonlocal structure. We also provide insights into individual behaviors shaping aggregate patterns in labor markets through numerical experiments.

AI Key Findings

Generated Oct 01, 2025

Methodology

The research employs a combination of mathematical modeling, numerical simulations, and analytical techniques to study the dynamics of coupled systems with non-linear interactions and time-dependent boundary conditions.

Key Results

- Established existence and uniqueness of global-in-time solutions for the coupled HJB-FP system

- Derived explicit expressions for the value functions and probability densities under specific terminal conditions

- Demonstrated compactness properties of the solution spaces through careful analysis of measure-valued processes

Significance

This work provides a rigorous mathematical foundation for understanding complex systems with interacting components, with potential applications in economics, finance, and operations research where coupled decision-making processes are prevalent.

Technical Contribution

The paper introduces a novel framework for analyzing coupled Hamilton-Jacobi-Bellman and Fokker-Planck equations with measure-valued solutions, combining stochastic control theory with modern PDE analysis techniques.

Novelty

This work distinguishes itself through its simultaneous treatment of both value function and density evolution equations, along with the use of measure-valued processes to handle defective probability densities in the context of optimal control problems.

Limitations

- The analysis assumes specific forms for the terminal conditions and interaction kernels that may limit generalizability

- The computational complexity remains high for large-scale systems with many interacting components

Future Work

- Extension to more general terminal conditions and non-smooth interaction functions

- Development of efficient numerical algorithms for high-dimensional systems

- Application to real-world problems in financial mathematics and game theory

Paper Details

PDF Preview

Similar Papers

Found 4 papersTwo-Sided Manipulation Games in Stable Matching Markets

Hadi Hosseini, Grzegorz Lisowski, Shraddha Pathak

Approximate Strategyproofness in Large, Two-Sided Matching Markets

Lars Lien Ankile, Kjartan Krange, Yuto Yagi

Two-Sided Learning in Decentralized Matching Markets

Bryce L. Ferguson, Jason R. Marden, Vade Shah

Comments (0)