Summary

We consider price competition among multiple sellers over a selling horizon of $T$ periods. In each period, sellers simultaneously offer their prices and subsequently observe their respective demand that is unobservable to competitors. The demand function for each seller depends on all sellers' prices through a private, unknown, and nonlinear relationship. To address this challenge, we propose a semi-parametric least-squares estimation of the nonlinear mean function, which does not require sellers to communicate demand information. We show that when all sellers employ our policy, their prices converge at a rate of $O(T^{-1/7})$ to the Nash equilibrium prices that sellers would reach if they were fully informed. Each seller incurs a regret of $O(T^{5/7})$ relative to a dynamic benchmark policy. A theoretical contribution of our work is proving the existence of equilibrium under shape-constrained demand functions via the concept of $s$-concavity and establishing regret bounds of our proposed policy. Technically, we also establish new concentration results for the least squares estimator under shape constraints. Our findings offer significant insights into dynamic competition-aware pricing and contribute to the broader study of non-parametric learning in strategic decision-making.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper employs a semi-parametric least-squares estimation approach for nonlinear mean function in a multi-seller pricing scenario with unknown and nonlinear demand relationships. The method does not require sellers to share demand information.

Key Results

- Sellers' prices converge to Nash equilibrium prices at a rate of O(T^(-1/7)) when all employ the proposed policy.

- Each seller incurs a regret of O(T^(5/7)) relative to a dynamic benchmark policy.

- Existence of equilibrium under shape-constrained demand functions is proven via the concept of s-concavity.

- New concentration results for the least squares estimator under shape constraints are established.

Significance

This research offers significant insights into dynamic competition-aware pricing and contributes to the broader study of non-parametric learning in strategic decision-making.

Technical Contribution

The paper introduces a novel semi-parametric least-squares estimation method for nonlinear mean functions in sequential price competition, proving equilibrium existence and establishing regret bounds.

Novelty

The work differentiates itself by addressing s-concavity to prove equilibrium existence and by developing concentration results for least squares estimators under shape constraints in a pricing competition context.

Limitations

- The model assumes sellers simultaneously offer prices without knowing competitors' prices.

- The analysis does not account for potential external market factors influencing demand.

Future Work

- Explore the applicability of the proposed method in more complex market structures.

- Investigate the impact of additional market factors on the pricing strategies.

Paper Details

PDF Preview

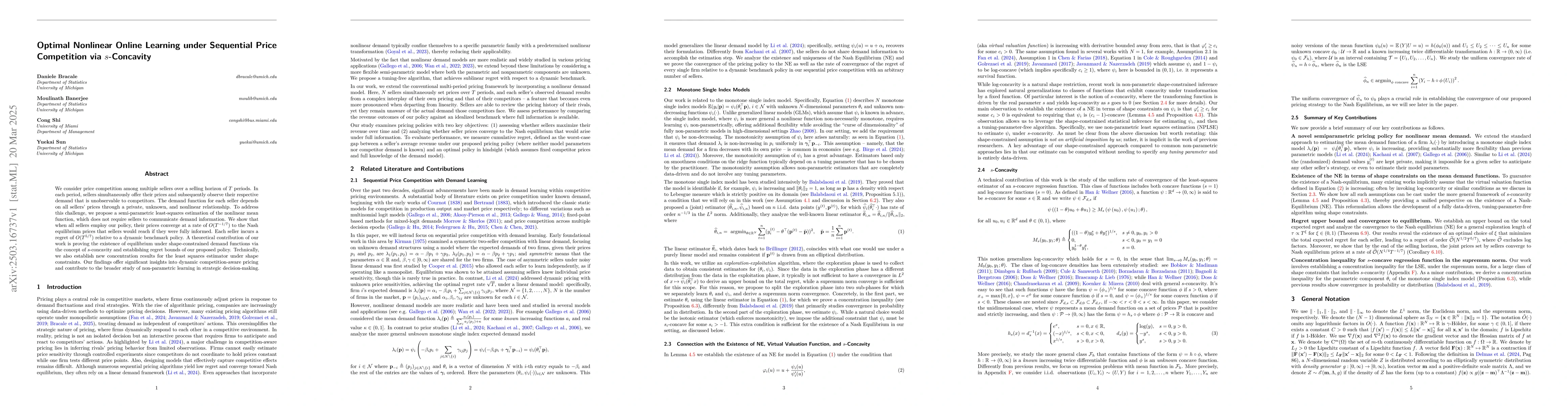

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOnline Optimization Algorithms in Repeated Price Competition: Equilibrium Learning and Algorithmic Collusion

Martin Bichler, Matthias Oberlechner, Julius Durmann

No citations found for this paper.

Comments (0)