Summary

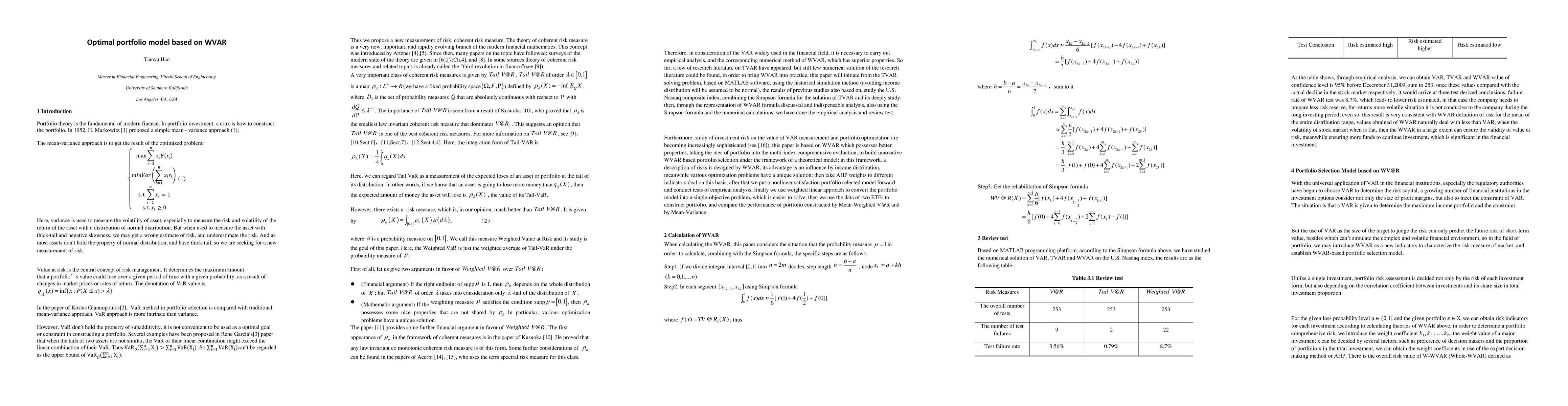

This article is focused on using a new measurement of risk-- Weighted Value at Risk to develop a new method of constructing initiate from the TVAR solving problem, based on MATLAB software, using the historical simulation method (avoiding income distribution will be assumed to be normal), the results of previous studies also based on, study the U.S. Nasdaq composite index, combining the Simpson formula for the solution of TVAR and its deeply study; then, through the representation of WVAR formula discussed and indispensable analysis, also using the Simpson formula and the numerical calculations, we have done the empirical analysis and review test. this paper is based on WVAR which possesses better properties, taking the idea of portfolio into the multi-index comprehensive evaluation, to build innovative WVAR based portfolio selection under the framework of a theoretical model; in this framework, a description of risks is designed by WVAR, its advantage is no influence by income distribution, meanwhile various optimization problems have a unique solution; then take AHP weights to different indicators deal on this basis, after that we put a nonlinear satisfaction portfolio selected model forward and conduct tests of empirical analysis, finally we use weighted linear approach to convert the portfolio model into a single-objective problem, which is easier to solve, then we use the data of two ETFs to construct portfolio, and compare the performance of portfolio constructed by Mean-Weighted V@R and by Mean-Variance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)