Summary

This paper is devoted to study the optimal portfolio problem. Harry Markowitz's Ph.D. thesis prepared the ground for the mathematical theory of finance. In modern portfolio theory, we typically find asset returns that are modeled by a random variable with an elliptical distribution and the notion of portfolio risk is described by an appropriate risk measure. In this paper, we propose new stochastic models for the asset returns that are based on Jumps- Diffusion (J-D) distributions. This family of distributions are more compatible with stylized features of asset returns. On the other hand, in the past decades, we find attempts in the literature to use well-known risk measures, such as Value at Risk and Expected Shortfall, in this context. Unfortunately, one drawback with these previous approaches is that no explicit formulas are available and numerical approximations are used to solve the optimization problem. In this paper, we propose to use a new coherent risk measure, so-called, Entropic Value at Risk(EVaR), in the optimization problem. For certain models, including a jump-diffusion distribution, this risk measure yields an explicit formula for the objective function so that the optimization problem can be solved without resorting to numerical approximations.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper proposes new stochastic models for asset returns based on Jumps-Diffusion (J-D) distributions, which are more compatible with stylized features of asset returns. It introduces Entropic Value at Risk (EVaR) as a coherent risk measure for the optimization problem, providing explicit formulas for the objective function in certain models, including jump-diffusion distributions, allowing optimization without numerical approximations.

Key Results

- New stochastic models for asset returns using Jumps-Diffusion (J-D) distributions.

- Entropic Value at Risk (EVaR) proposed as a coherent risk measure.

- Explicit formulas for the objective function in certain models, including jump-diffusion distributions, enabling optimization without numerical approximations.

- Karush-Kuhn-Tucker (KKT) conditions proven sufficient for optimal solutions in both proposed models.

- Efficient frontier analysis for multivariate model 1 (Jump-Diffusion) using EVaR and standard deviation as risk measures.

Significance

This research is significant as it addresses the limitations of previous approaches that lack explicit formulas for optimization, especially when using well-known risk measures like Value at Risk and Expected Shortfall in non-elliptical distributions.

Technical Contribution

The paper introduces Entropic Value at Risk (EVaR) as a novel coherent risk measure and provides explicit formulas for optimization in Jumps-Diffusion models, which is a significant technical contribution to portfolio optimization under non-elliptical distributions.

Novelty

The novelty of this work lies in the use of Jumps-Diffusion distributions for modeling asset returns and the application of Entropic Value at Risk (EVaR) as a coherent risk measure that allows for explicit optimization formulas, distinguishing it from previous research that relied on numerical approximations for similar problems.

Limitations

- The proposed models and risk measure are only applicable to certain distributions (Jumps-Diffusion).

- The paper does not extensively compare the performance of EVaR with other risk measures in various market conditions.

Future Work

- Investigate the performance of EVaR in different market scenarios and compare it with other risk measures.

- Explore the applicability of the proposed models and EVaR to other financial instruments and markets.

- Extend the research to incorporate more complex financial models and risk factors.

Paper Details

PDF Preview

Key Terms

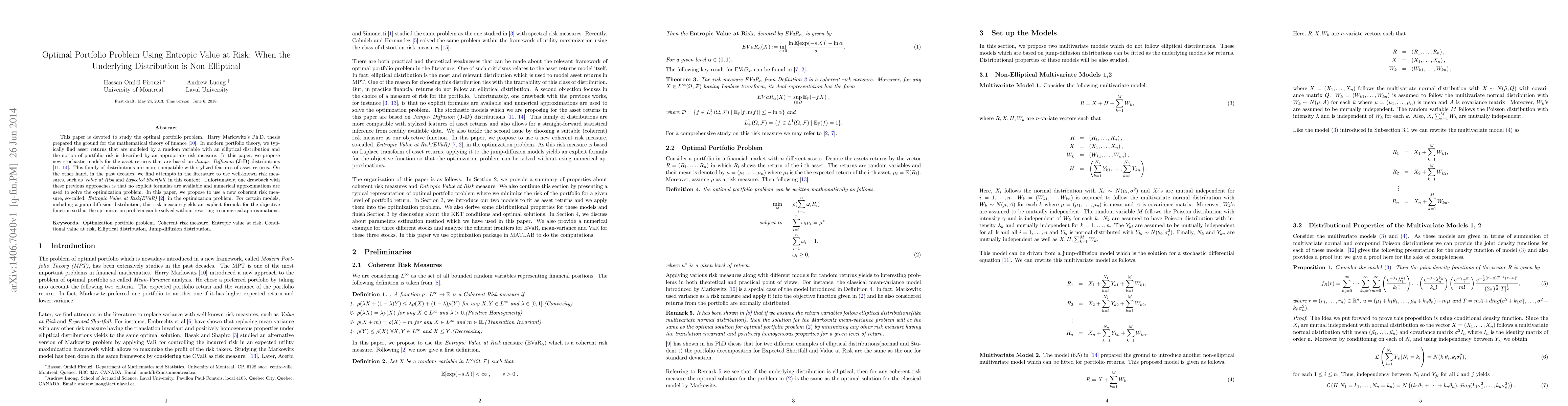

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust portfolio selection under Recovery Average Value at Risk

Cosimo Munari, Stefan Weber, Justin Plückebaum

| Title | Authors | Year | Actions |

|---|

Comments (0)