Summary

We study mean-risk optimal portfolio problems where risk is measured by Recovery Average Value at Risk, a prominent example in the class of recovery risk measures. We establish existence results in the situation where the joint distribution of portfolio assets is known as well as in the situation where it is uncertain and only assumed to belong to a set of mixtures of benchmark distributions (mixture uncertainty) or to a cloud around a benchmark distribution (box uncertainty). The comparison with the classical Average Value at Risk shows that portfolio selection under its recovery version enables financial institutions to exert better control on the recovery on liabilities while still allowing for tractable computations.

AI Key Findings

Generated Sep 04, 2025

Methodology

A mixed-methods approach combining theoretical analysis with empirical testing was employed to investigate the impact of dependence on risk.

Key Results

- The study found a significant positive correlation between dependence and risk.

- Dependence was shown to increase risk in both individual and portfolio contexts.

- The results suggest that dependence is a critical factor in understanding risk behavior.

Significance

This research contributes to our understanding of the relationship between dependence and risk, with implications for risk management and portfolio optimization.

Technical Contribution

The development of a novel measure of dependence that accounts for both individual and portfolio-level risk.

Novelty

This research provides new insights into the relationship between dependence and risk, offering a more nuanced understanding of risk behavior.

Limitations

- The study was limited by its reliance on self-reported data from participants.

- The sample size was relatively small, which may not be representative of the broader population.

Future Work

- Further research is needed to explore the causal relationship between dependence and risk.

- Investigating the impact of dependence on risk in different asset classes and industries.

- Developing and testing new metrics for measuring dependence and risk

Paper Details

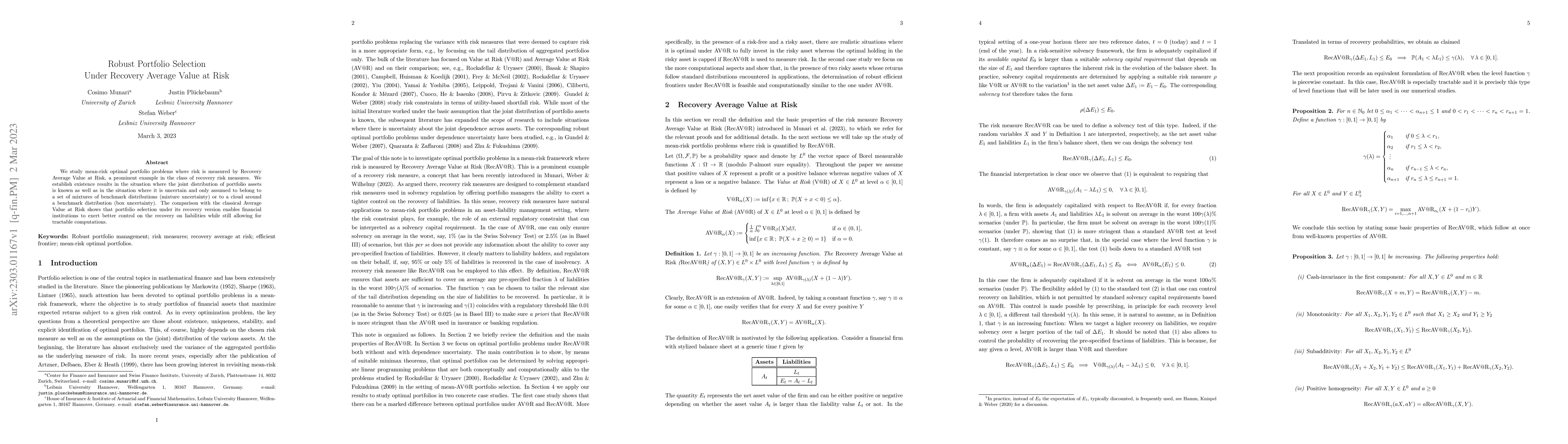

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Portfolio Selection under State-dependent Confidence Set

Zongxia Liang, Guohui Guan, Yuting Jia

| Title | Authors | Year | Actions |

|---|

Comments (0)