Authors

Summary

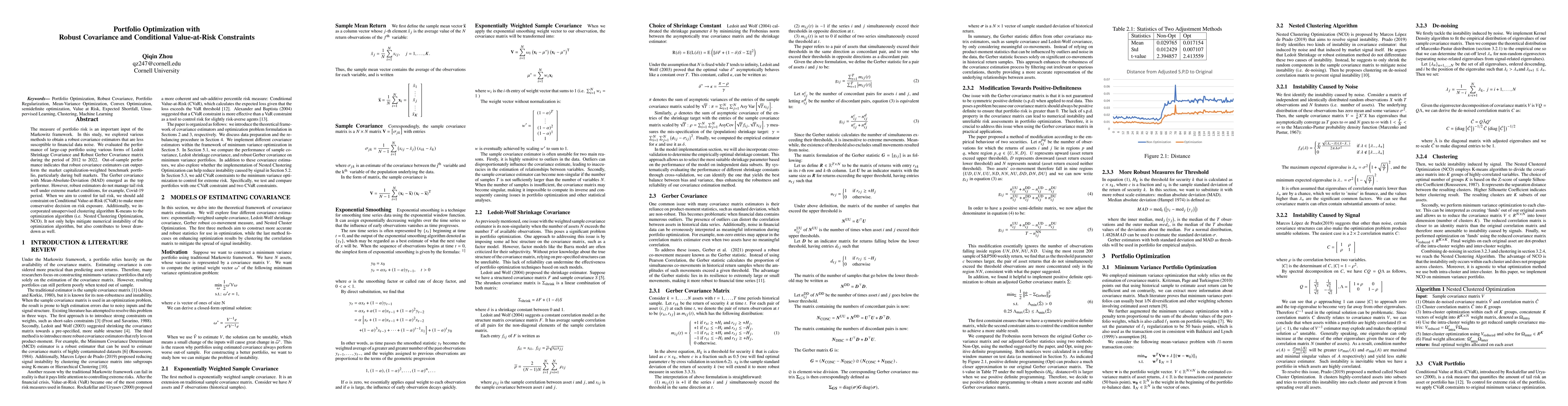

The measure of portfolio risk is an important input of the Markowitz framework. In this study, we explored various methods to obtain a robust covariance estimators that are less susceptible to financial data noise. We evaluated the performance of large-cap portfolio using various forms of Ledoit Shrinkage Covariance and Robust Gerber Covariance matrix during the period of 2012 to 2022. Out-of-sample performance indicates that robust covariance estimators can outperform the market capitalization-weighted benchmark portfolio, particularly during bull markets. The Gerber covariance with Mean-Absolute-Deviation (MAD) emerged as the top performer. However, robust estimators do not manage tail risk well under extreme market conditions, for example, Covid-19 period. When we aim to control for tail risk, we should add constraint on Conditional Value-at-Risk (CVaR) to make more conservative decision on risk exposure. Additionally, we incorporated unsupervised clustering algorithm K-means to the optimization algorithm (i.e. Nested Clustering Optimization, NCO). It not only helps mitigate numerical instability of the optimization algorithm, but also contributes to lower drawdown as well.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMean-Covariance Robust Risk Measurement

Daniel Kuhn, Viet Anh Nguyen, Damir Filipović et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)