Summary

By employing the technique of enlargement of filtrations, we demonstrate how to incorporate information about the future trend of the stochastic interest rate process into a financial model. By modeling the interest rate as an affine diffusion process, we obtain explicit formulas for the additional expected logarithmic utility in solving the optimal portfolio problem. We begin by solving the problem when the additional information directly refers to the interest rate process, and then extend the analysis to the case where the information relates to the values of an underlying Markov chain. The dynamics of this chain may depend on anticipated market information, jump at predefined epochs, and modulate the parameters of the stochastic interest rate process. The theoretical study is then complemented by an illustrative numerical analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

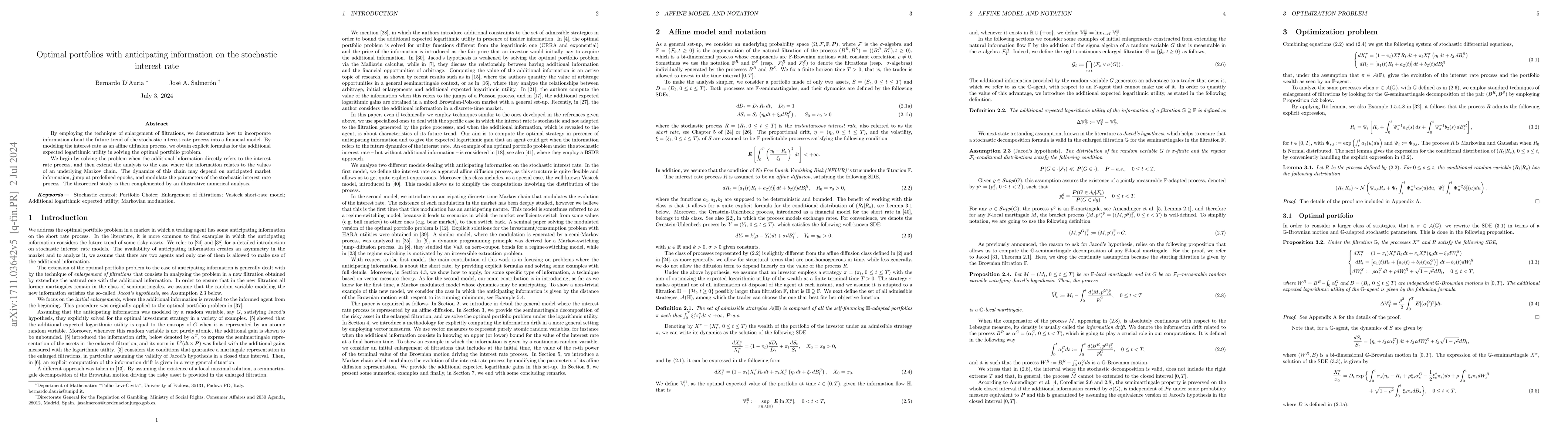

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)