Bernardo D'Auria

10 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Optimal stopping of Gauss-Markov bridges

We solve the non-discounted, finite-horizon optimal stopping problem of a Gauss-Markov bridge by using a time-space transformation approach. The associated optimal stopping boundary is proved to be ...

Optimal exercise of American options under time-dependent Ornstein-Uhlenbeck processes

We study the barrier that gives the optimal time to exercise an American option written on a time-dependent Ornstein--Uhlenbeck process, a diffusion often adopted by practitioners to model commodity...

Before and after default: information and optimal portfolio via anticipating calculus

Default risk calculus plays a crucial role in portfolio optimization when the risky asset is under threat of bankruptcy. However, traditional stochastic control techniques are not applicable in this...

An Anticipative Markov Modulated Market

A Markovian modulation captures the trend in the market and influences the market coefficients accordingly. The different scenarios presented by the market are modeled as the distinct states of a di...

Anticipative information in a Brownian-Poissonmarket: the binary information

The binary information collects all those events that may or may not occur. With this kind of variables, a large amount of information can be captured, in particular, about financial assets and thei...

Optimal stopping of an Ornstein-Uhlenbeck bridge

We make a rigorous analysis of the existence and characterization of the free boundary related to the optimal stopping problem that maximizes the mean of an Ornstein--Uhlenbeck bridge. The result in...

Optimal portfolios with anticipating information on the stochastic interest rate

By employing the technique of enlargement of filtrations, we demonstrate how to incorporate information about the future trend of the stochastic interest rate process into a financial model. By mode...

Time evaluation of portfolio for asymmetrically informed traders

We study the anticipating version of the classical portfolio optimization problem in a financial market with the presence of a trader who possesses privileged information about the future (insider inf...

Modelling a storage system of a wind farm with a ramp-rate limitation: a semi-Markov modulated Brownian bridge approach

We propose a new methodology to simulate the discounted penalty applied to a wind-farm operator by violating ramp-rate limitation policies. It is assumed that the operator manages a wind turbine plugg...

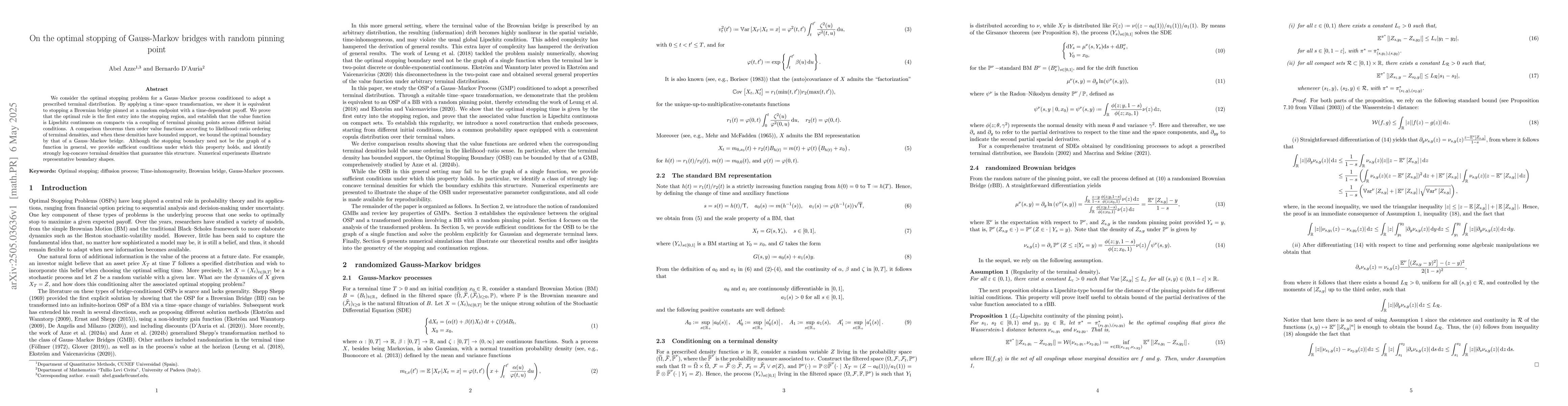

On the optimal stopping of Gauss-Markov bridges with random pinning points

We consider the optimal stopping problem for a Gauss-Markov process conditioned to adopt a prescribed terminal distribution. By applying a time-space transformation, we show it is equivalent to stoppi...