Summary

Default risk calculus plays a crucial role in portfolio optimization when the risky asset is under threat of bankruptcy. However, traditional stochastic control techniques are not applicable in this scenario, and additional assumptions are required to obtain the optimal solution in a before-and-after default context. We propose an alternative approach using forward integration, which allows to avoid one of the restrictive assumptions, the Jacod density hypothesis. We demonstrate that, in the case of logarithmic utility, the weaker intensity hypothesis is the appropriate condition for optimality. Furthermore, we establish the semimartingale decomposition of the risky asset in the filtration that is progressively enlarged to accommodate the default process, under the assumption of the existence of the optimal portfolio. This work aims to provide valueable insights for developing effective risk management strategies when facing default risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

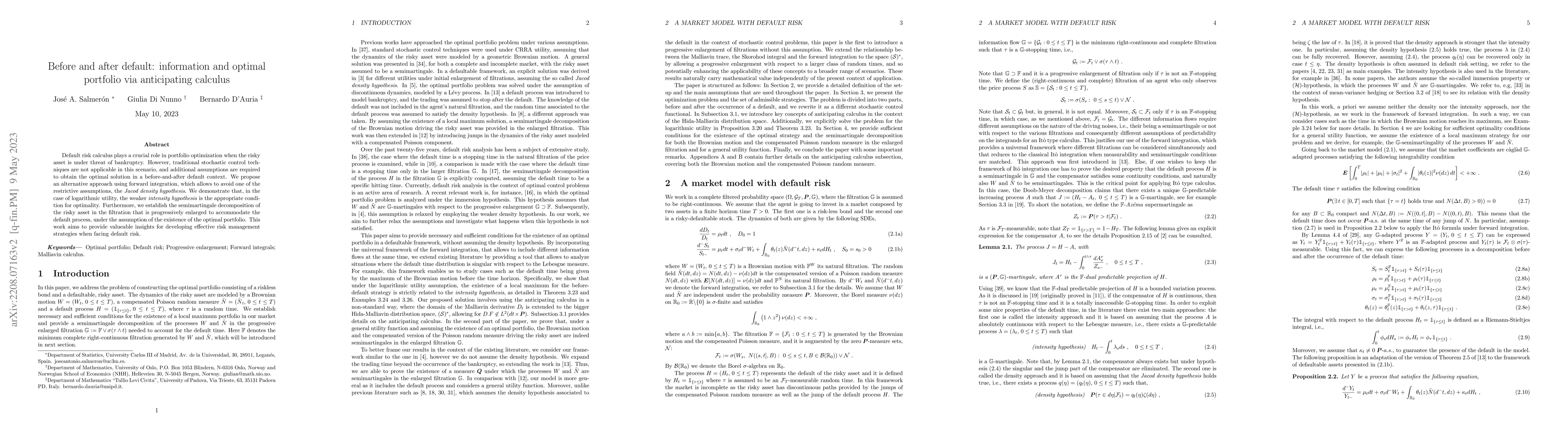

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMalliavin calculus and its application to robust optimal portfolio for an insider

Chao Yu, Yuhan Cheng

Delegated portfolio management with random default

Thibaut Mastrolia, Alberto Gennaro

No citations found for this paper.

Comments (0)