Authors

Summary

We are considering the problem of optimal portfolio delegation between an investor and a portfolio manager under a random default time. We focus on a novel variation of the Principal-Agent problem adapted to this framework. We address the challenge of an uncertain investment horizon caused by an exogenous random default time, after which neither the agent nor the principal can access the market. This uncertainty introduces significant complexities in analyzing the problem, requiring distinct mathematical approaches for two cases: when the random default time falls within the initial time frame [0,T] and when it extends beyond this period. We develop a theoretical framework to model the stochastic dynamics of the investment process, incorporating the random default time. We then analyze the portfolio manager's investment decisions and compensation mechanisms for both scenarios. In the first case, where the default time could be unbounded, we apply traditional results from Backward Stochastic Differential Equations (BSDEs) and control theory to address the agent problem. In the second case, where the default time is within the interval [0,T], the problem becomes more intricate due to the degeneracy of the BSDE's driver. For both scenarios, we demonstrate that the contracting problem can be resolved by examining the existence of solutions to integro-partial Hamilton-Jacobi-Bellman (HJB) equations in both situations. We develop a deep-learning algorithm to solve the problem in high-dimension with no access to the optimizer of the Hamiltonian function.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

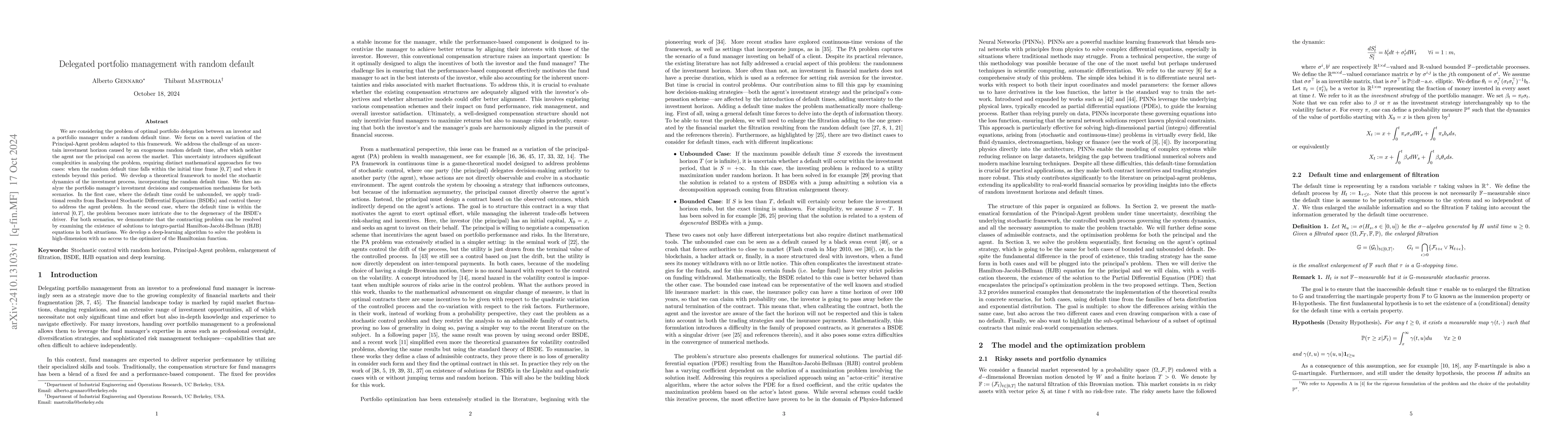

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBefore and after default: information and optimal portfolio via anticipating calculus

Giulia Di Nunno, Bernardo D'Auria, José A. Salmerón

No citations found for this paper.

Comments (0)