Authors

Summary

We study the power of price discrimination via an intermediary in bilateral trade, when there is a revenue-maximizing seller selling an item to a buyer with a private value drawn from a prior. Between the seller and the buyer, there is an intermediary that can segment the market by releasing information about the true values to the seller. This is termed signaling, and enables the seller to price discriminate. In this setting, Bergemann et al. showed the existence of a signaling scheme that simultaneously raises the optimal consumer surplus, guarantees the item always sells, and ensures the seller's revenue does not increase. Our work extends the positive result of Bergemann et al. to settings where the type space is larger, and where optimal auction is randomized, possibly over a menu that can be exponentially large. In particular, we consider two settings motivated by budgets: The first is when there is a publicly known budget constraint on the price the seller can charge and the second is the FedEx problem where the buyer has a private deadline or service level (equivalently, a private budget that is guaranteed to never bind). For both settings, we present a novel signaling scheme and its analysis via a continuous construction process that recreates the optimal consumer surplus guarantee of Bergemann et al. The settings we consider are special cases of the more general problem where the buyer has a private budget constraint in addition to a private value. We finally show that our positive results do not extend to this more general setting. Here, we show that any efficient signaling scheme necessarily transfers almost all the surplus to the seller instead of the buyer.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

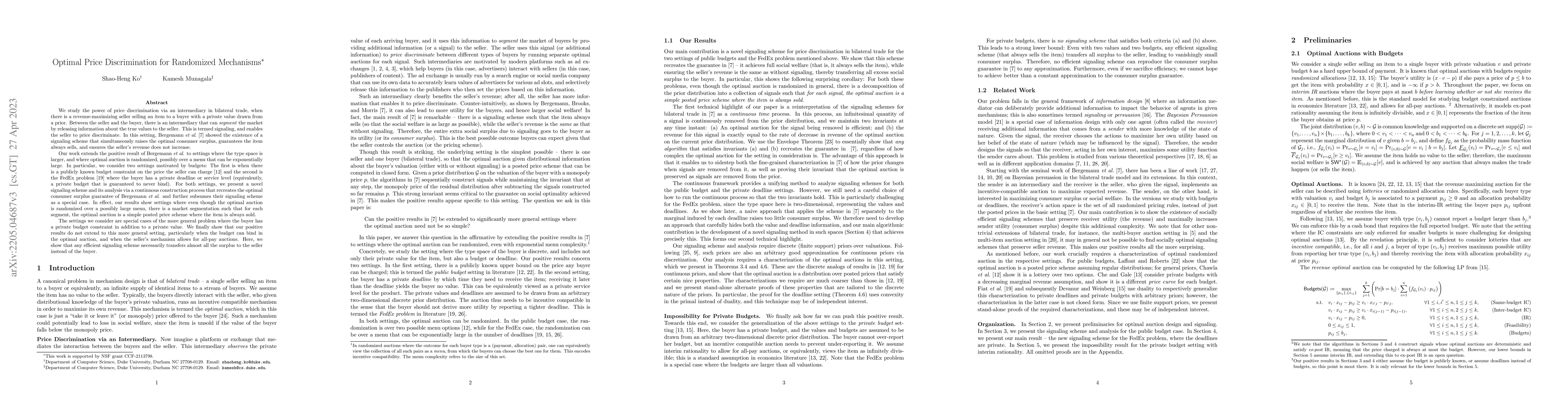

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFair Price Discrimination

Kamesh Munagala, Yiheng Shen, Siddhartha Banerjee et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)