Authors

Summary

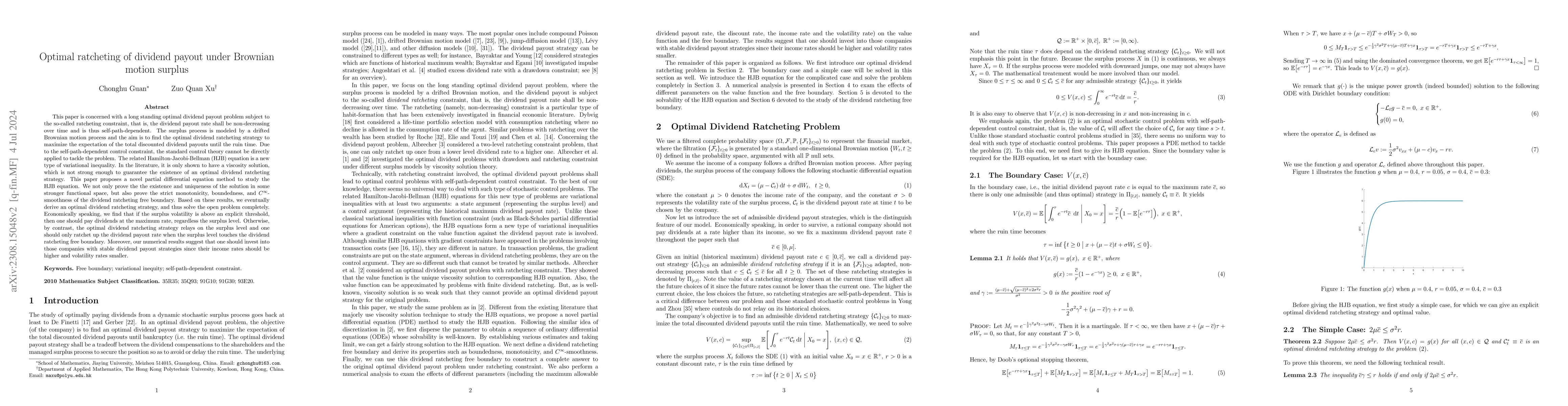

This paper is concerned with a long standing optimal dividend payout problem in insurance subject to the so-called ratcheting constraint, that is, the dividend payout rate shall be non-decreasing over time. The surplus process is modeled by a drifted Brownian motion process and the aim is to find the optimal dividend ratcheting strategy to maximize the expectation of the total discounted dividend payouts until the ruin time. Due to the path-dependent constraint, the standard control theory cannot be directly applied to tackle the problem. The related Hamilton-Jacobi-Bellman (HJB) equation is a new type of variational inequality. In the literature, it is only shown to have a viscosity solution, which is not strong enough to guarantee the existence of an optimal dividend ratcheting strategy. This paper proposes a novel partial differential equation method to study the HJB equation. We not only prove the the existence and uniqueness of the solution in some stronger functional space, but also prove the monotonicity, boundedness, and $C^{\infty}$-smoothness of the dividend ratcheting free boundary. Based on these results, we eventually derive an optimal dividend ratcheting strategy, and thus solve the open problem completely. Economically, we find that if the surplus volatility is above an explicit threshold, then one should pay dividends at the maximum rate, regardless the surplus level. Otherwise, by contrast, the optimal dividend ratcheting strategy relays on the surplus level and one should only ratchet up the dividend payout rate when the surplus level touches the dividend ratcheting free boundary.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal dividend payout with path-dependent drawdown constraint

Zuo Quan Xu, Chonghu Guan, Jiacheng Fan

| Title | Authors | Year | Actions |

|---|

Comments (0)