Summary

In this paper we investigate a new class of growth rate maximization problems based on impulse control strategies such that the average number of trades per time unit does not exceed a fixed level. Moreover, we include proportional transaction costs to make the portfolio problem more realistic. We provide a Verification Theorem to compute the optimal growth rate as well as an optimal trading strategy. Furthermore, we prove the existence of a constant boundary strategy which is optimal. At the end, we compare our approach to other discrete-time growth rate maximization problems in numerical examples. It turns out that constant boundary strategies with a small average number of trades per unit perform nearly as good as the classical optimal solutions with infinite activity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

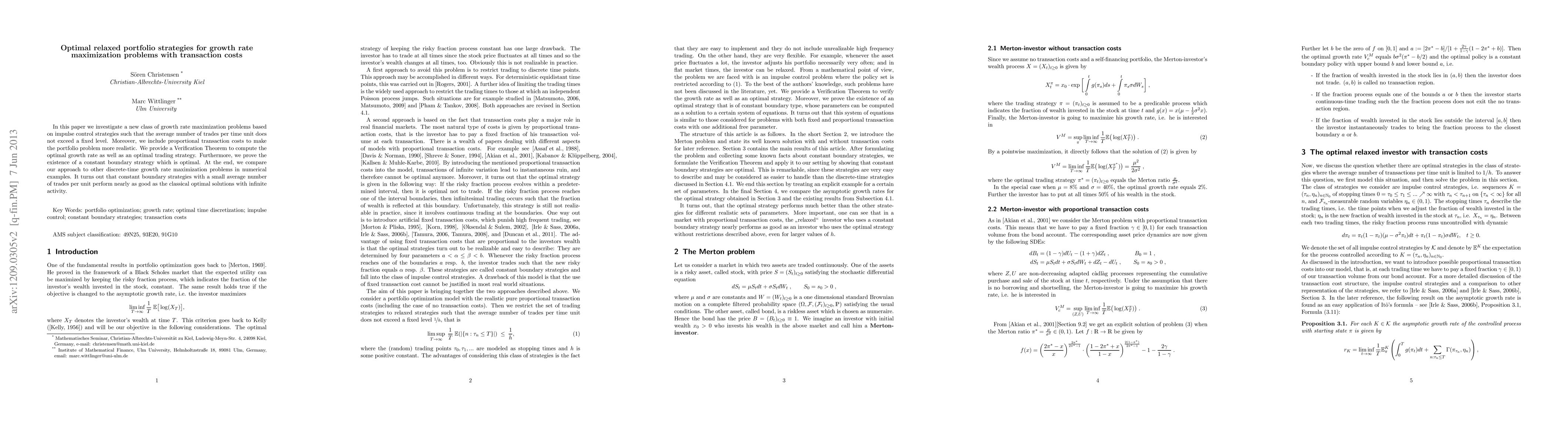

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Frequency-Based Optimal Portfolio with Transaction Costs

Chung-Han Hsieh, Yi-Shan Wong

| Title | Authors | Year | Actions |

|---|

Comments (0)