Summary

We propose a flexible framework for hedging a contingent claim by holding static positions in vanilla European calls, puts, bonds, and forwards. A model-free expression is derived for the optimal static hedging strategy that minimizes the expected squared hedging error subject to a cost constraint. The optimal hedge involves computing a number of expectations that reflect the dependence among the contingent claim and the hedging assets. We provide a general method for approximating these expectations analytically in a general Markov diffusion market. To illustrate the versatility of our approach, we present several numerical examples, including hedging path-dependent options and options written on a correlated asset.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

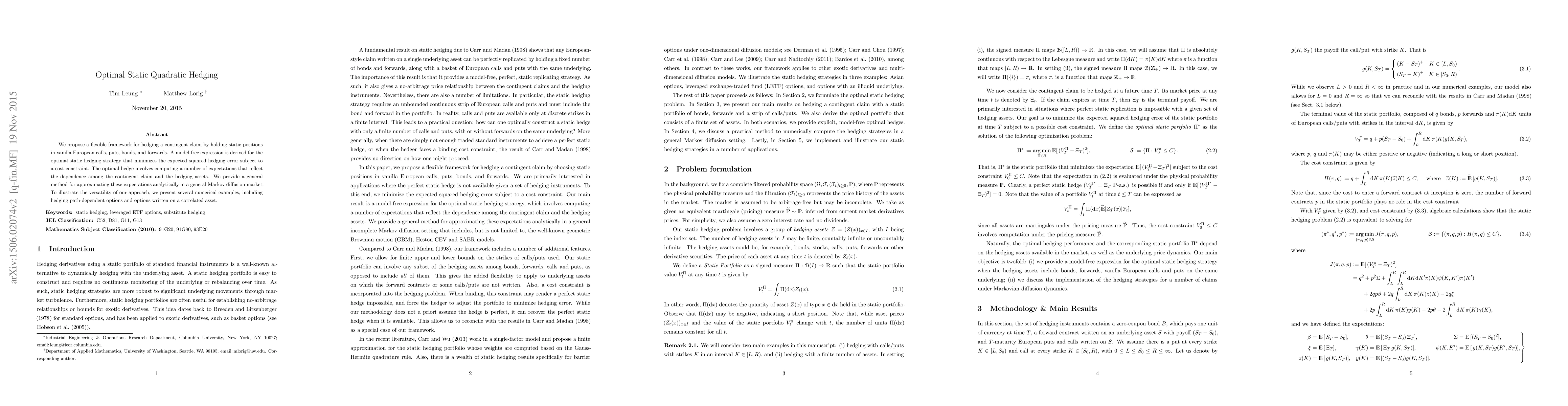

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)