Summary

In this paper we formulate and study an optimal switching problem under partial information. In our model the agent/manager/investor attempts to maximize the expected reward by switching between different states/investments. However, he is not fully aware of his environment and only an observation process, which contains partial information about the environment/underlying, is accessible. It is based on the partial information carried by this observation process that all decisions must be made. We propose a probabilistic numerical algorithm based on dynamic programming, regression Monte Carlo methods, and stochastic filtering theory to compute the value function. In this paper, the approximation of the value function and the corresponding convergence result are obtained when the underlying and observation processes satisfy the linear Kalman-Bucy setting. A numerical example is included to show some specific features of partial information.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

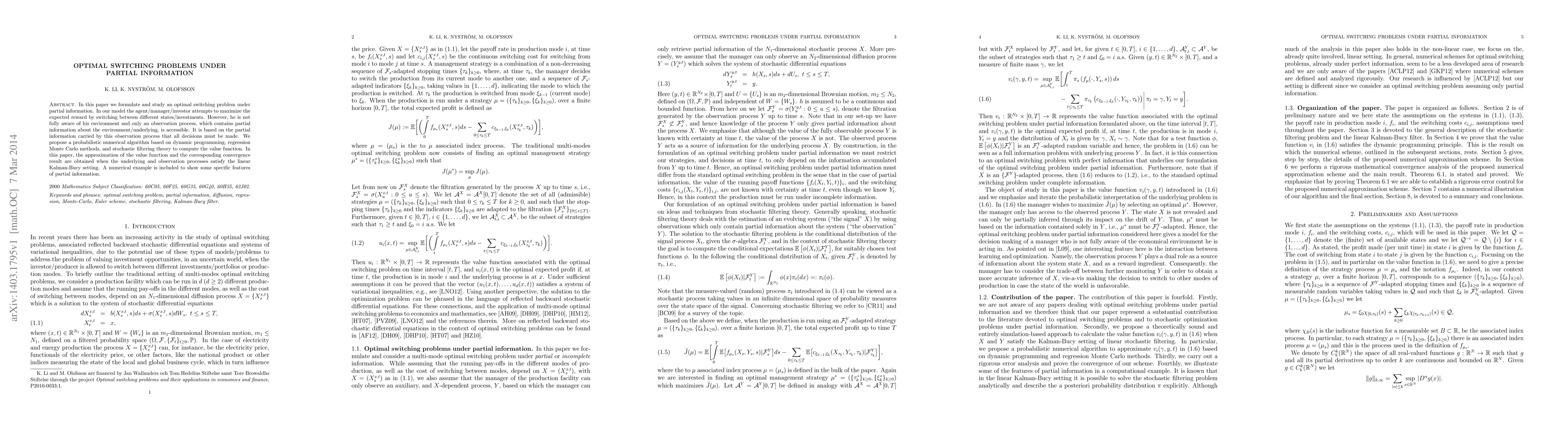

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)