Authors

Summary

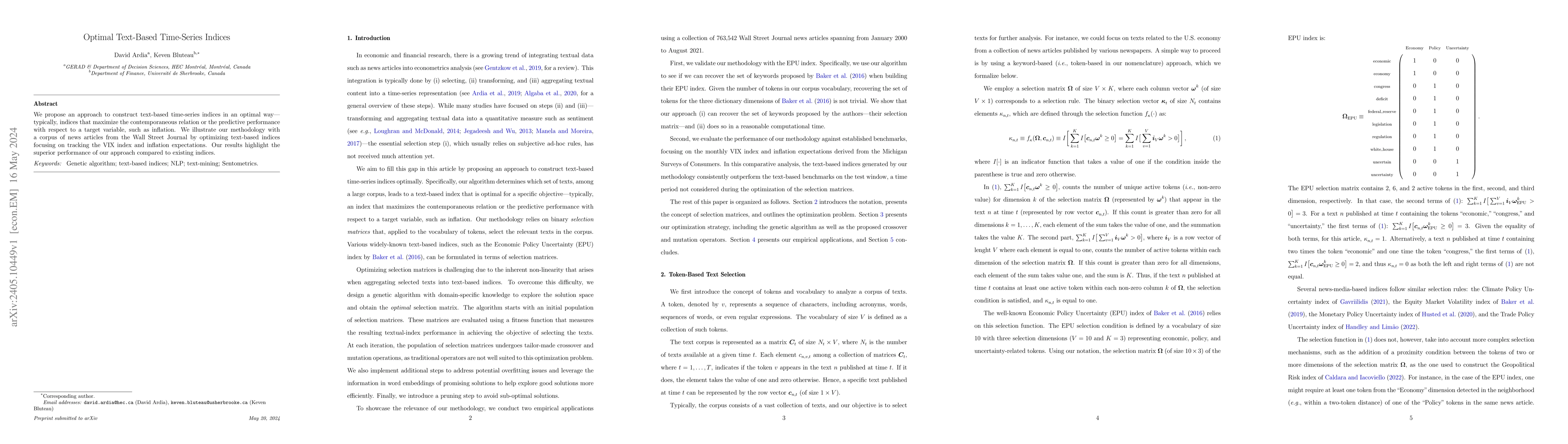

We propose an approach to construct text-based time-series indices in an optimal way--typically, indices that maximize the contemporaneous relation or the predictive performance with respect to a target variable, such as inflation. We illustrate our methodology with a corpus of news articles from the Wall Street Journal by optimizing text-based indices focusing on tracking the VIX index and inflation expectations. Our results highlight the superior performance of our approach compared to existing indices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImproving Text-based Early Prediction by Distillation from Privileged Time-Series Text

Jinghui Liu, Anthony Nguyen, Karin Verspoor et al.

No citations found for this paper.

Comments (0)