Summary

We study an optimal execution problem in illiquid markets with both instantaneous and persistent price impact and stochastic resilience when only absolutely continuous trading strategies are admissible. In our model the value function can be described by a three-dimensional system of backward stochastic differential equations (BSDE) with a singular terminal condition in one component. We prove existence and uniqueness of a solution to the BSDE system and characterize both the value function and the optimal strategy in terms of the unique solution to the BSDE system. Our existence proof is based on an asymptotic expansion of the BSDE system at the terminal time that allows us to express the system in terms of a equivalent system with finite terminal value but singular driver.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

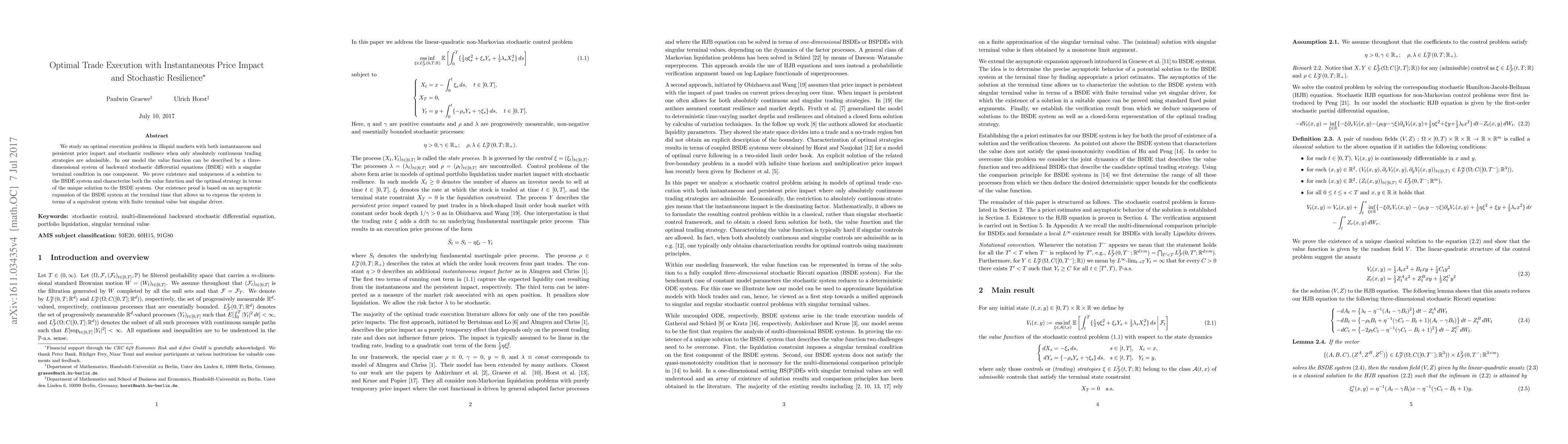

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSelf-exciting price impact via negative resilience in stochastic order books

Julia Ackermann, Mikhail Urusov, Thomas Kruse

Optimal trade execution under small market impact and portfolio liquidation with semimartingale strategies

Ulrich Horst, Evgueni Kivman

| Title | Authors | Year | Actions |

|---|

Comments (0)