Summary

We develop a dynamic trading strategy in the Linear Quadratic Regulator (LQR) framework. By including a price mean-reversion signal into the optimization program, in a trading environment where market impact is linear and stage costs are quadratic, we obtain an optimal trading curve that reacts opportunistically to price changes while retaining its ability to satisfy smooth or hard completion constraints. The optimal allocation is affine in the spot price and in the number of outstanding shares at any time, and it can be fully derived iteratively. It is also aggressive in the money, meaning that it accelerates whenever the price is favorable, with an intensity that can be calibrated by the practitioner. Since the LQR may yield locally negative participation rates (i.e round trip trades) which are often undesirable, we show that the aforementioned optimization problem can be improved and solved under positivity constraints following a Model Predictive Control (MPC) approach. In particular, it is smoother and more consistent with the completion constraint than putting a hard floor on the participation rate. We finally examine how the LQR can be simplified in the continuous trading context, which allows us to derive a closed formula for the trading curve under further assumptions, and we document a two-step strategy for the case where trades can also occur in an additional dark pool.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

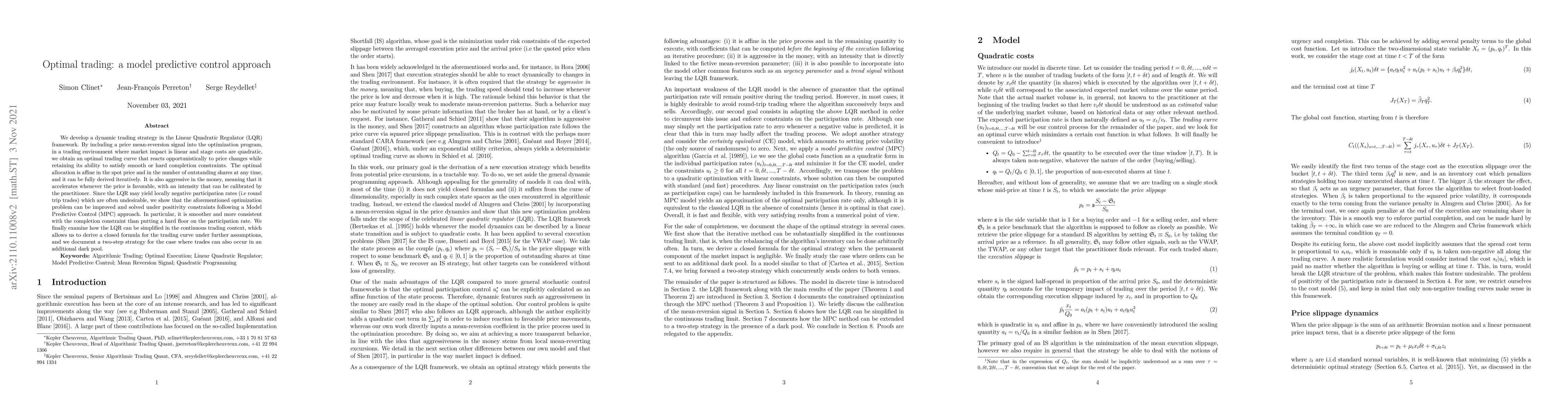

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA singular stochastic control approach for optimal pairs trading with proportional transaction costs

Bayesian Learning Approach to Model Predictive Control

Namhoon Cho, Antonios Tsourdos, Seokwon Lee et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)