Summary

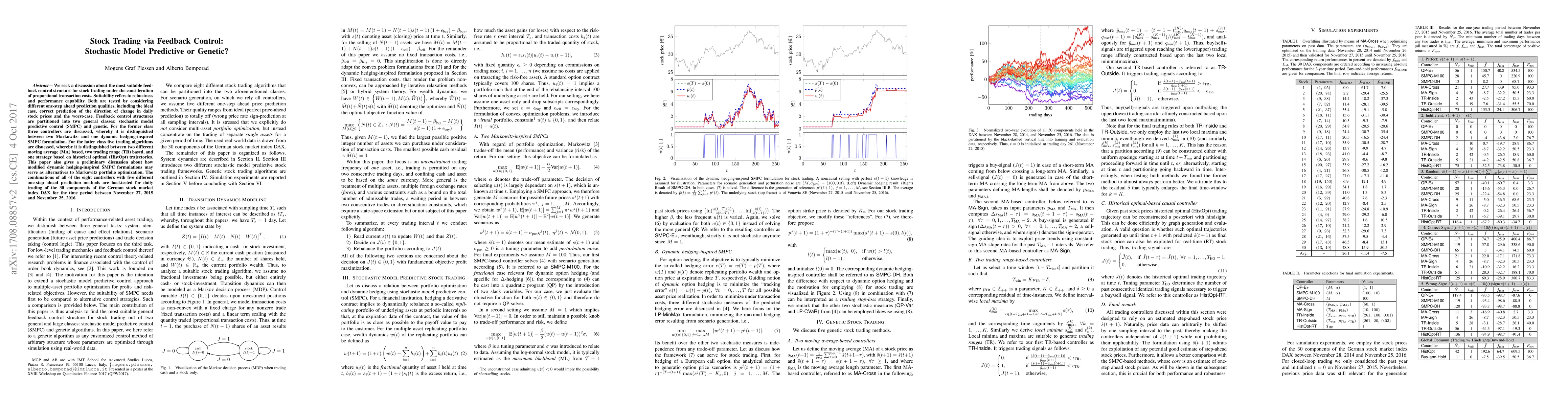

We seek a discussion about the most suitable feedback control structure for stock trading under the consideration of proportional transaction costs. Suitability refers to robustness and performance capability. Both are tested by considering different one-step ahead prediction qualities, including the ideal case, correct prediction of the direction of change in daily stock prices and the worst-case. Feedback control structures are partitioned into two general classes: stochastic model predictive control (SMPC) and genetic. For the former class three controllers are discussed, whereby it is distinguished between two Markowitz- and one dynamic hedging-inspired SMPC formulation. For the latter class five trading algorithms are disucssed, whereby it is distinguished between two different moving average (MA) based, two trading range (TR) based, and one strategy based on historical optimal (HistOpt) trajectories. This paper also gives a preliminary discussion about how modified dynamic hedging-inspired SMPC formulations may serve as alternatives to Markowitz portfolio optimization. The combinations of all of the eight controllers with five different one-step ahead prediction methods are backtested for daily trading of the 30 components of the German stock market index DAX for the time period between November 27, 2015 and November 25, 2016.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)