Summary

The starting point of this paper is the so-called Robust Positive Expectation (RPE) Theorem, a result which appears in literature in the context of Simultaneous Long-Short stock trading. This theorem states that using a combination of two specially-constructed linear feedback trading controllers, one long and one short, the expected value of the resulting gain-loss function is guaranteed to be robustly positive with respect to a large class of stochastic processes for the stock price. The main result of this paper is a generalization of this theorem. Whereas previous work applies to a single stock, in this paper, we consider a pair of stocks. To this end, we make two assumptions on their expected returns. The first assumption involves price correlation between the two stocks and the second involves a bounded non-zero momentum condition. With known uncertainty bounds on the parameters associated with these assumptions, our new version of the RPE Theorem provides necessary and sufficient conditions on the positive feedback parameter K of the controller under which robust positive expectation is assured. We also demonstrate that our result generalizes the one existing for the single-stock case. Finally, it is noted that our results also can be interpreted in the context of pairs trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

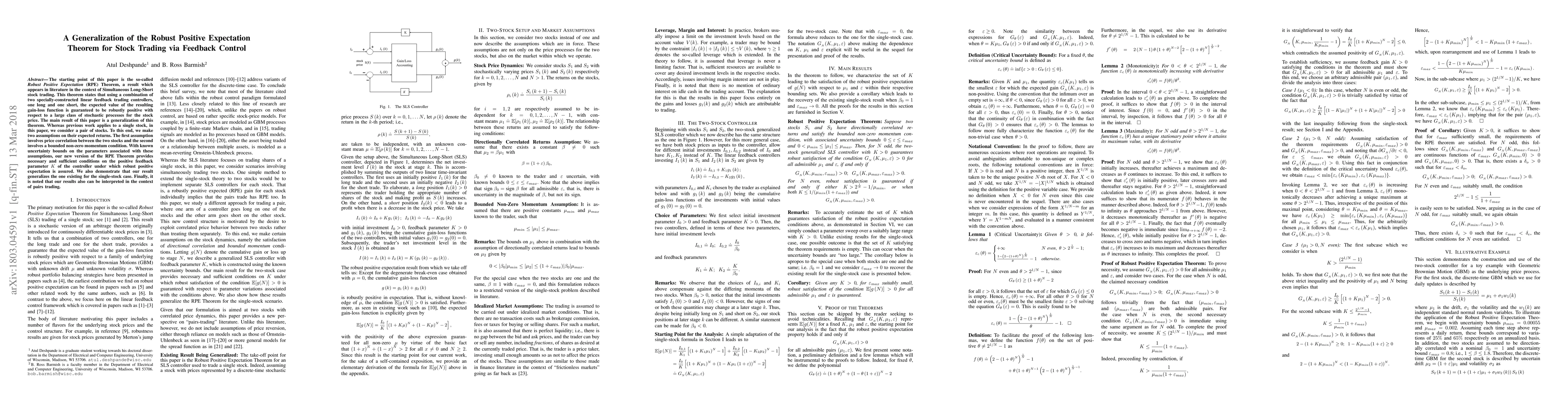

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)