Summary

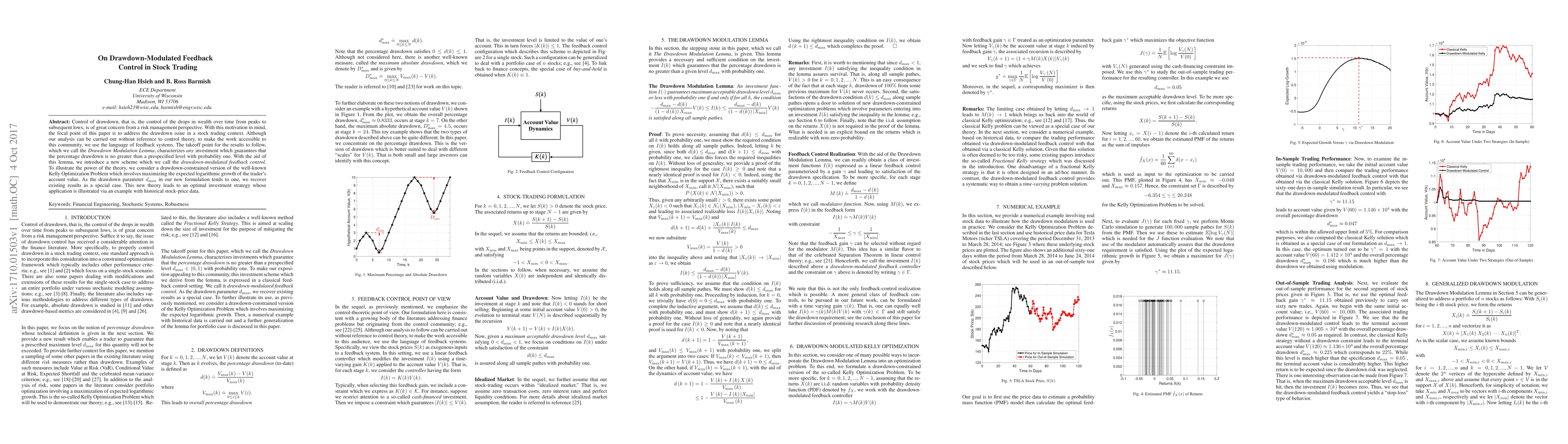

Control of drawdown, that is, the control of the drops in wealth over time from peaks to subsequent lows, is of great concern from a risk management perspective. With this motivation in mind, the focal point of this paper is to address the drawdown issue in a stock trading context. Although our analysis can be carried out without reference to control theory, to make the work accessible to this community, we use the language of feedback systems. The takeoff point for the results to follow, which we call the Drawdown Modulation Lemma, characterizes any investment which guarantees that the percentage drawdown is no greater than a prespecified level with probability one. With the aid of this lemma, we introduce a new scheme which we call the drawdown-modulated feedback control. To illustrate the power of the theory, we consider a drawdown-constrained version of the well-known Kelly Optimization Problem which involves maximizing the expected logarithmic growth of the trader's account value. As the drawdown parameter dmax in our new formulation tends to one, we recover existing results as a special case. This new theory leads to an optimal investment strategy whose application is illustrated via an example with historical stock-price data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)