Authors

Summary

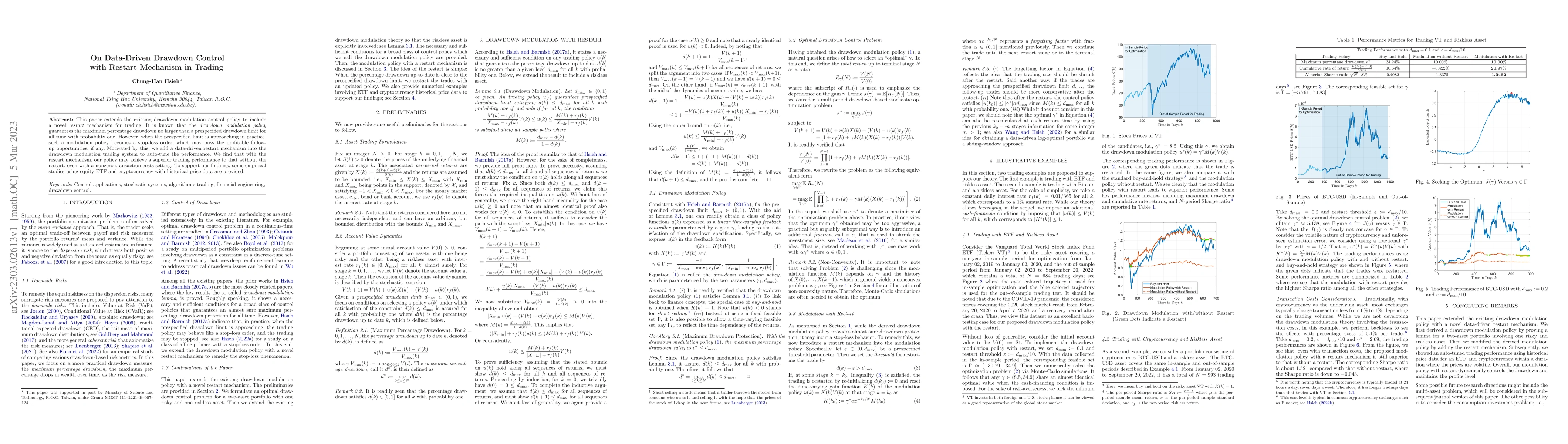

This paper extends the existing drawdown modulation control policy to include a novel restart mechanism for trading. It is known that the drawdown modulation policy guarantees the maximum percentage drawdown no larger than a prespecified drawdown limit for all time with probability one. However, when the prespecified limit is approaching in practice, such a modulation policy becomes a stop-loss order, which may miss the profitable follow-up opportunities if any. Motivated by this, we add a data-driven restart mechanism into the drawdown modulation trading system to auto-tune the performance. We find that with the restart mechanism, our policy may achieve a superior trading performance to that without the restart, even with a nonzero transaction costs setting. To support our findings, some empirical studies using equity ETF and cryptocurrency with historical price data are provided.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersData Trading Combination Auction Mechanism based on the Exponential Mechanism

Kongyang Chen, Bing Mi, Zeming Xu

An Incentive Mechanism for Trading Personal Data in Data Markets

Sayan Biswas, Catuscia Palamidessi, Kangsoo Jung

No citations found for this paper.

Comments (0)