Summary

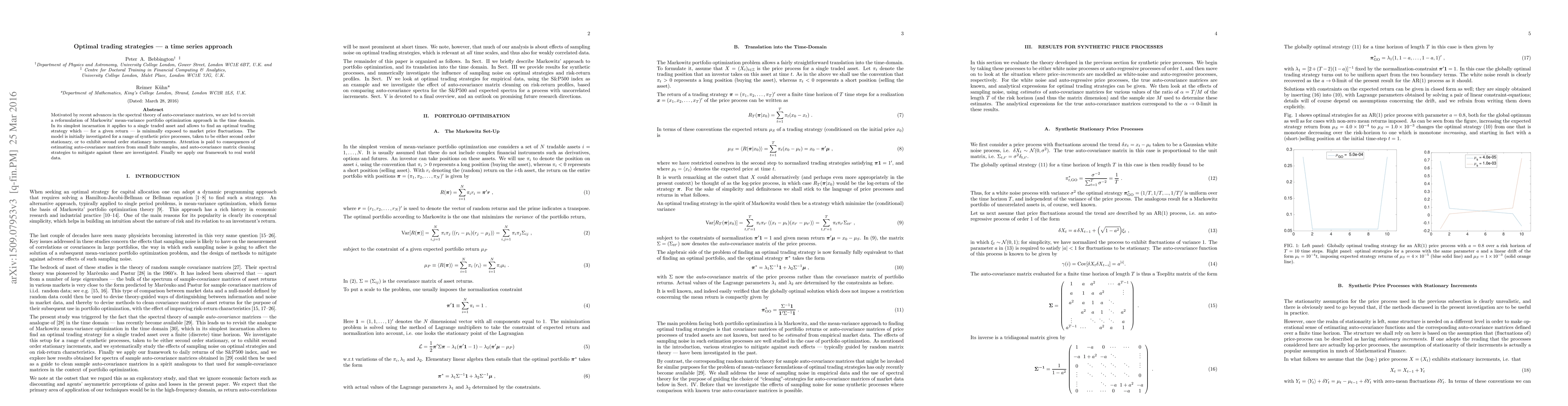

Motivated by recent advances in the spectral theory of auto-covariance matrices, we are led to revisit a reformulation of Markowitz' mean-variance portfolio optimization approach in the time domain. In its simplest incarnation it applies to a single traded asset and allows to find an optimal trading strategy which - for a given return - is minimally exposed to market price fluctuations. The model is initially investigated for a range of synthetic price processes, taken to be either second order stationary, or to exhibit second order stationary increments. Attention is paid to consequences of estimating auto-covariance matrices from small finite samples, and auto-covariance matrix cleaning strategies to mitigate against these are investigated. Finally we apply our framework to real world data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA posteriori Trading-inspired Model-free Time Series Segmentation

Mogens Graf Plessen

Deep Optimal Timing Strategies for Time Series

Fan Zhou, Siqiao Xue, Chen Pan et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)