Summary

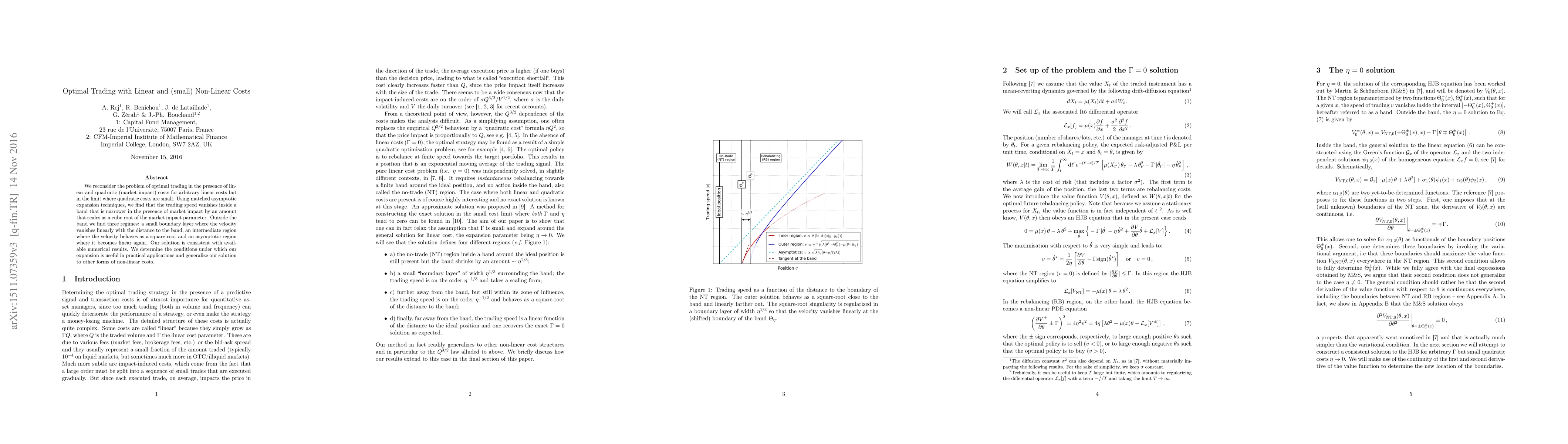

We reconsider the problem of optimal trading in the presence of linear and quadratic costs, for arbitrary linear costs but in the limit where quadratic costs are small. Using matched asymptotic expansion techniques, we find that the trading speed vanishes inside a band that is narrower than in the absence of quadratic costs, by an amount that scales as the one-third power of quadratic costs. Outside of the band, we find three regimes: a small boundary layer where the velocity vanishes linearly with the distance to the band, an intermediate region where the velocity behaves as a square-root of that distance, and a far region where it becomes linear. Our solution is consistent with available numerical results. We determine the conditions in which our expansion is useful in practical applications, and generalize our solution to other forms of non-linear costs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)