Summary

A hypothetical risk-neutral agent who trades to maximize the expected profit of the next trade will approximately exhibit long-term optimal behavior as long as this agent uses the vector $p = \nabla V (t, x)$ as effective microstructure alphas, where V is the Bellman value function for a smooth relaxation of the problem. Effective microstructure alphas are the steepest-ascent direction of V , equal to the generalized momenta in a dual Hamiltonian formulation. This simple heuristics has wide-ranging practical implications; indeed, most utility-maximization problems that require implementation via discrete limit-order-book markets can be treated by our method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

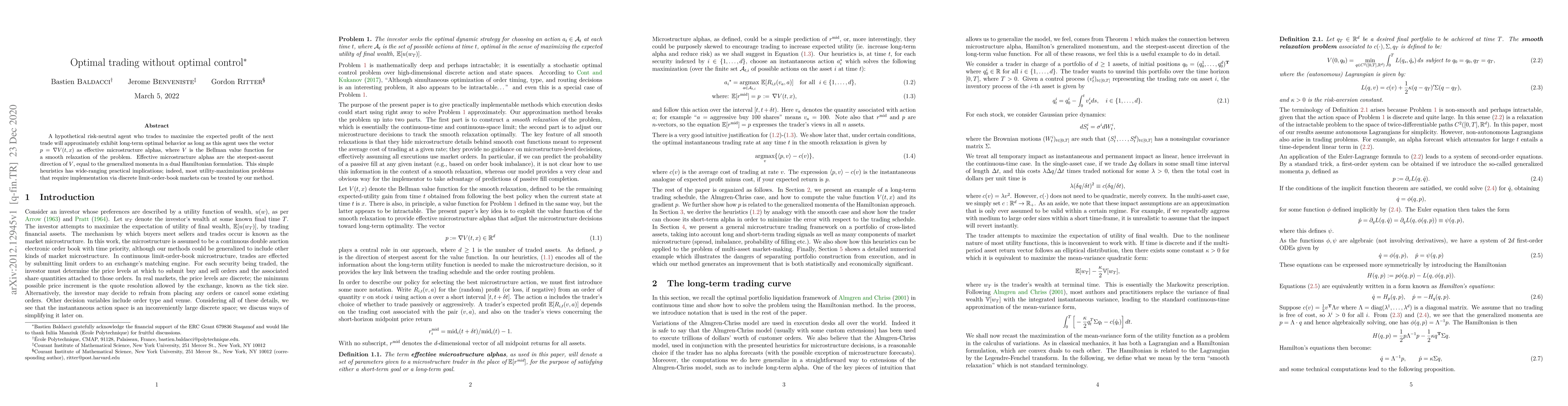

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)