Summary

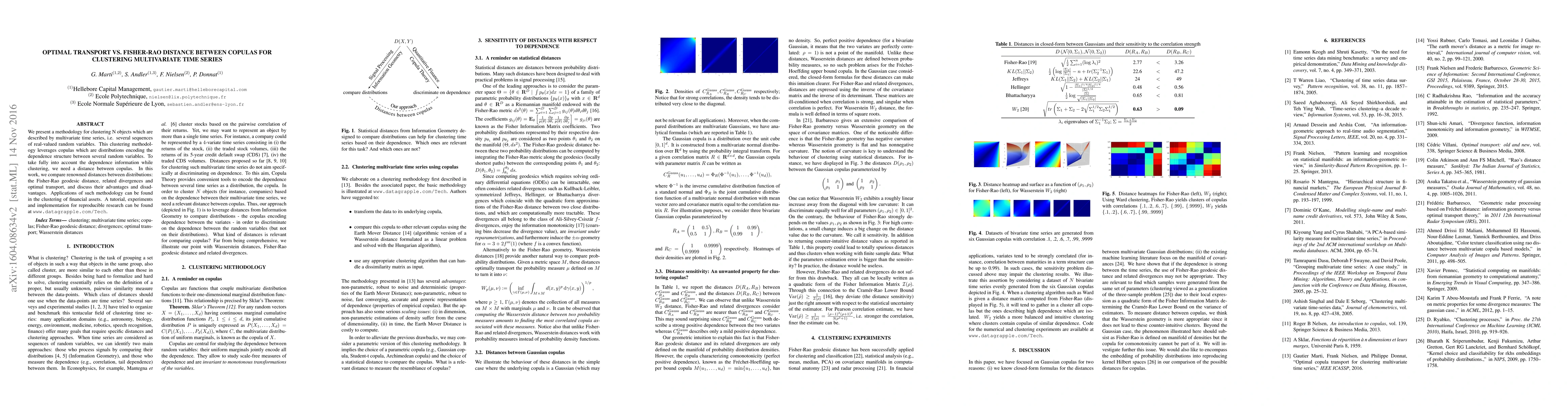

We present a methodology for clustering N objects which are described by multivariate time series, i.e. several sequences of real-valued random variables. This clustering methodology leverages copulas which are distributions encoding the dependence structure between several random variables. To take fully into account the dependence information while clustering, we need a distance between copulas. In this work, we compare renowned distances between distributions: the Fisher-Rao geodesic distance, related divergences and optimal transport, and discuss their advantages and disadvantages. Applications of such methodology can be found in the clustering of financial assets. A tutorial, experiments and implementation for reproducible research can be found at www.datagrapple.com/Tech.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFisher-Rao distance and pullback SPD cone distances between multivariate normal distributions

Frank Nielsen

Clustering Multivariate Time Series using Energy Distance

Konstantinos Fokianos, Richard A. Davis, Leon Fernandes

| Title | Authors | Year | Actions |

|---|

Comments (0)