Summary

This study first reviews fuzzy random Portfolio selection theory and describes the concept of portfolio optimization model as a useful instrument for helping finance practitioners and researchers. Second, this paper specifically aims at applying possibility-based models for transforming the fuzzy random variables to the linear programming. The harmony search algorithm approaches to resolve the portfolio selection problem with the objective of return maximization is applied. We provide a numerical example to illustrate the proposed model. The results show that the evolutionary method of this paper with harmony search algorithm, can consistently handle the practical portfolio selection problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

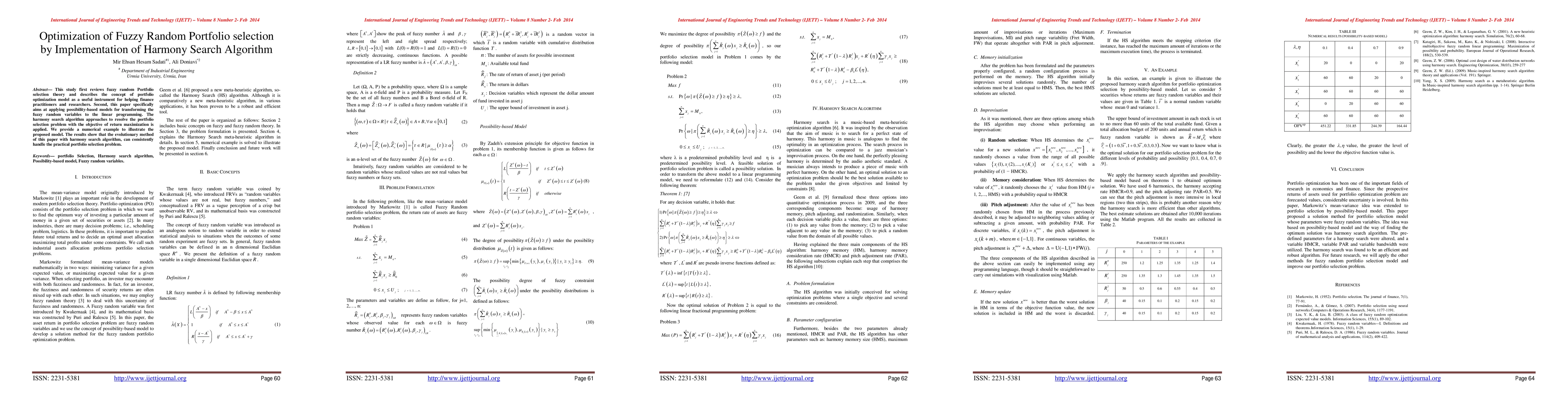

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulticriteria Portfolio Selection with Intuitionistic Fuzzy Goals as a Pseudoconvex Vector Optimization

Vuong D. Nguyen, Nguyen Kim Duyen, Nguyen Minh Hai et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)