Summary

Portfolio selection is one of the most important and vital decisions that a real or legal person, who invests in stock market should make. The main purpose of this paper is the determination of the optimal portfolio with regard to stock returns of companies, which are active in Tehran's stock market. For achieving this purpose, annual statistics of companies' stocks since Farvardin 1387 until Esfand 1392 have been used. For analyzing statistics, information of companies' stocks, the Cuckoo Optimization Algorithm (COA) and Knapsack Problem have been used with the aim of increasing the total return, in order to form a financial portfolio. At last, results merits of choosing the optimal portfolio using the COA rather than Genetic Algorithm are given

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

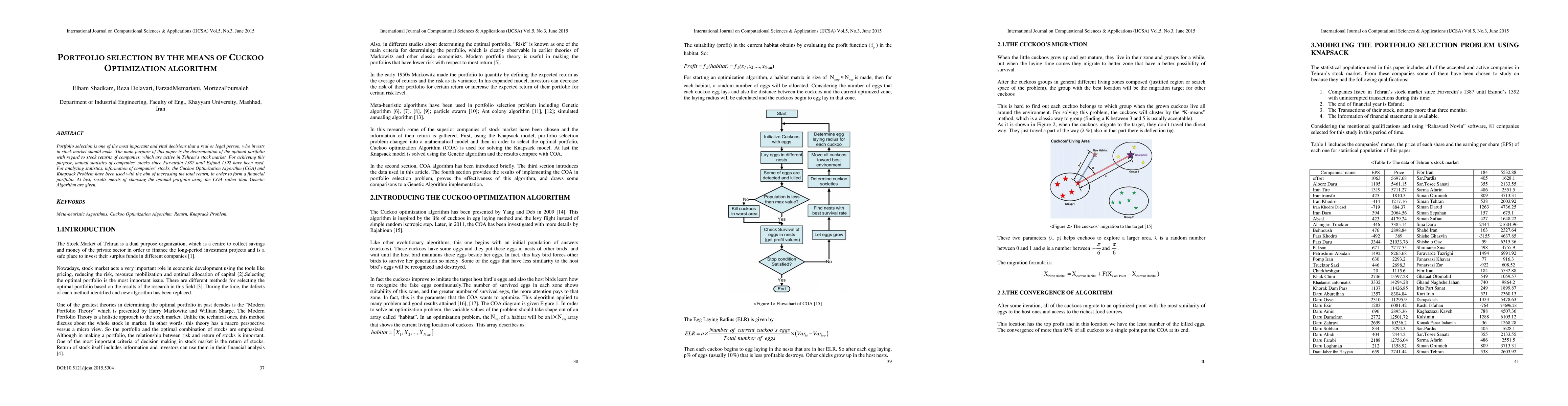

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)