Summary

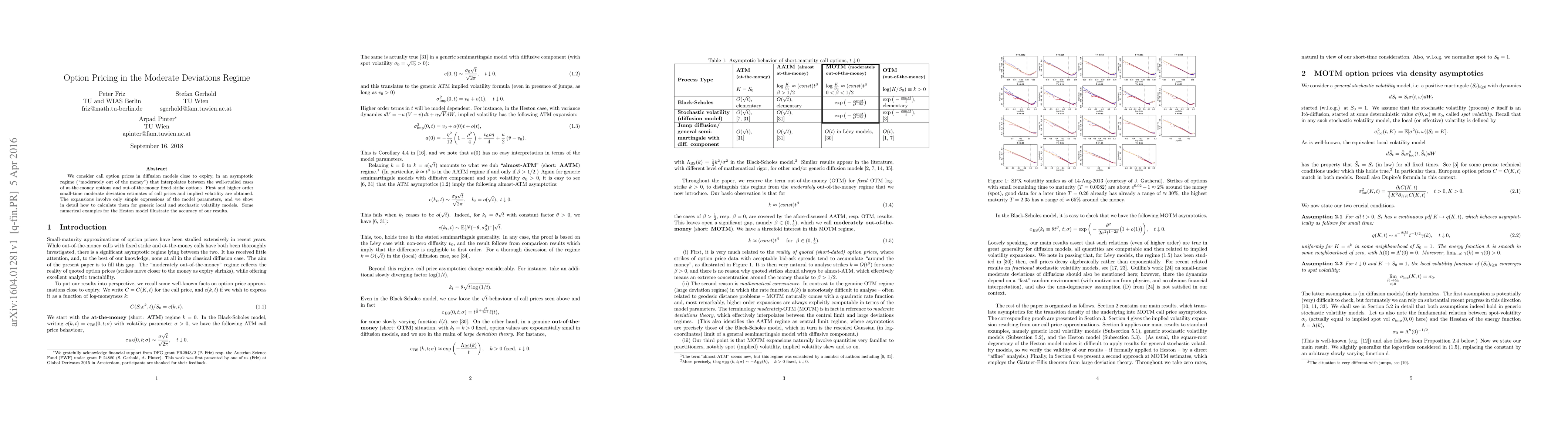

We consider call option prices in diffusion models close to expiry, in an asymptotic regime ("moderately out of the money") that interpolates between the well-studied cases of at-the-money options and out-of-the-money fixed-strike options. First and higher order small-time moderate deviation estimates of call prices and implied volatility are obtained. The expansions involve only simple expressions of the model parameters, and we show in detail how to calculate them for generic local and stochastic volatility models. Some numerical examples for the Heston model illustrate the accuracy of our results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRegime-based Implied Stochastic Volatility Model for Crypto Option Pricing

Tomaso Aste, Yuanrong Wang, Danial Saef

| Title | Authors | Year | Actions |

|---|

Comments (0)