Summary

We derive analytic series representations for European option prices in polynomial stochastic volatility models. This includes the Jacobi, Heston, Stein-Stein, and Hull-White models, for which we provide numerical case studies. We find that our polynomial option price series expansion performs as efficiently and accurately as the Fourier transform based method in the nested affine cases. We also derive and numerically validate series representations for option Greeks. We depict an extension of our approach to exotic options whose payoffs depend on a finite number of prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

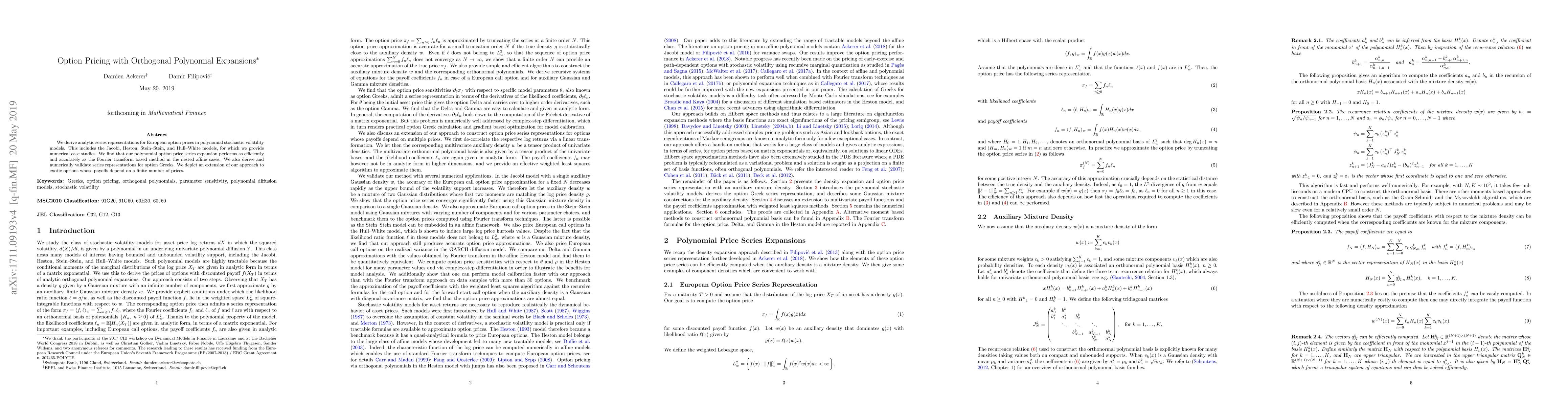

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOption Pricing with State-dependent Pricing Kernel

Chen Tong, Peter Reinhard Hansen, Zhuo Huang

| Title | Authors | Year | Actions |

|---|

Comments (0)