Summary

In this paper we study both analytic and numerical solutions of option pricing equations using systems of orthogonal polynomials. Using a Galerkin-based method, we solve the parabolic partial diferential equation for the Black-Scholes model using Hermite polynomials and for the Heston model using Hermite and Laguerre polynomials. We compare obtained solutions to existing semi-closed pricing formulas. Special attention is paid to the solution of Heston model at the boundary with vanishing volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

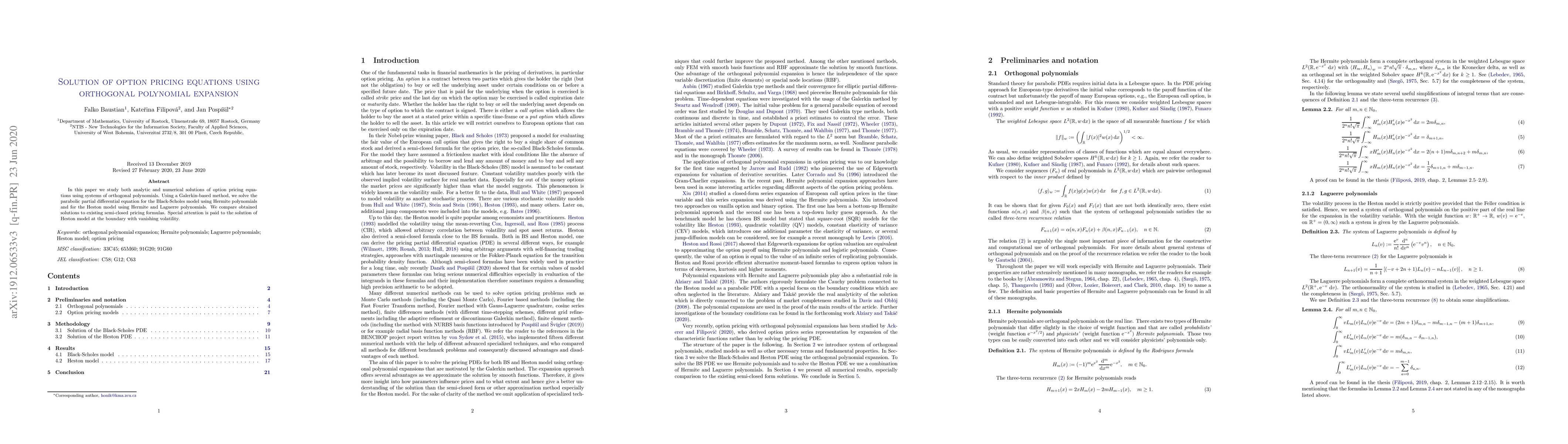

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)