Summary

Let $\mathbb{F}$ be a filtration and $\tau$ be a random time. Let $\mathbb{G}$ be the progressive enlargement of $\mathbb{F}$ with $\tau$. We study the validity of the following formula, called optional splitting formula : For any $\mathbb{G}$-optional process $Y$, there exist a $\mathbb{F}$-optional process $Y'$ and a function $Y"$ defined on $[0,\infty]\times(\mathbb{R}_+\times\Omega)$ being $\mathcal{B}[0,\infty]\otimes\mathcal{O}(\mathbb{F})$ measurable, such that $$ Y=Y'\ind_{[0,\tau)}+Y"(\tau)\ind_{[\tau,\infty)} $$ We are interested in this formula, because it has been taken for granted in number of recent works in credit risk modeling, whilst such a formula can not be true in general. Sufficient conditions will be given for the validity of the above formula as well as of its extension in the case of multiple random times.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

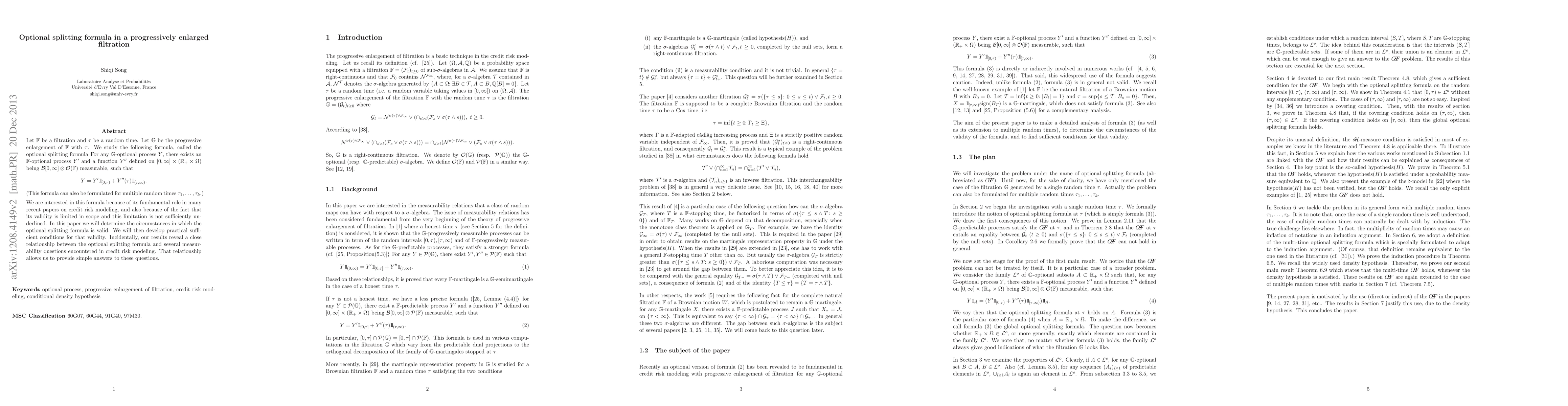

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)