Summary

In the present paper we provide a two-step principal protection strategy obtained by combining a modification of the Constant Proportion Portfolio Insurance (CPPI) algorithm and a classical Option Based Portfolio Insurance (OBPI) mechanism. Such a novel approach consists in assuming that the percentage of wealth invested in stocks cannot go under a fixed level, called guaranteed minimum equity exposure, and using such an adjusted CPPI portfolio as the underlying of an option. The first stage ensures to overcome the so called cash-in risk, typically related to a standard CPPI technique, while the second one guarantees the equity market participation. To show the effectiveness of our proposal we provide a detailed computational analysis within the Heston-Vasicek framework, numerically comparing the evaluation of the price of European plain vanilla options when the underlying is either a purely risky asset, a standard CPPI portfolio and a CPPI with guaranteed minimum equity exposure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

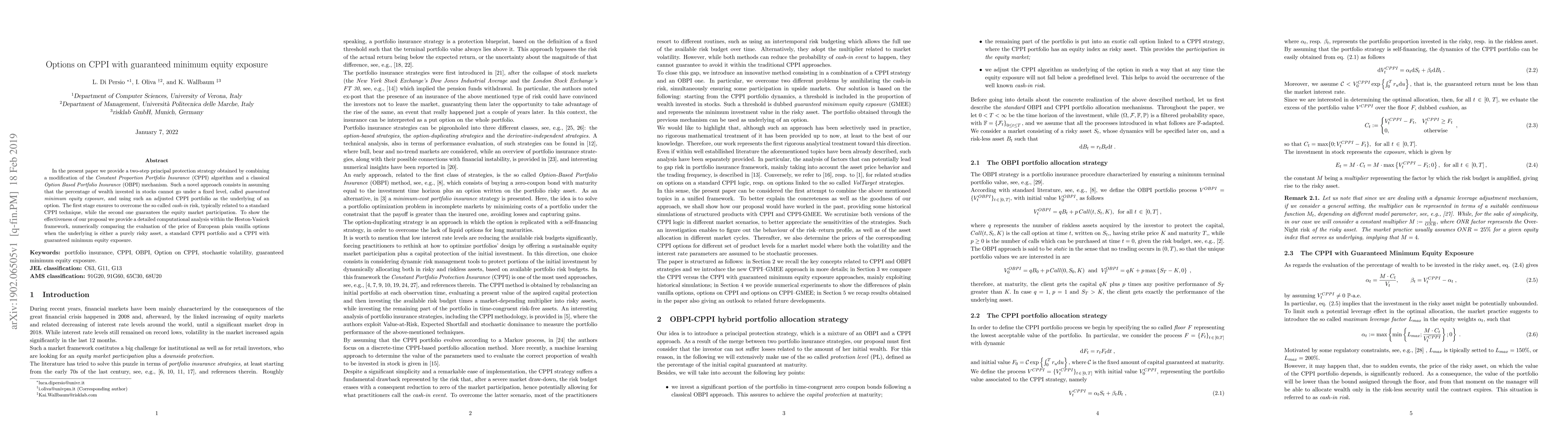

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)