Summary

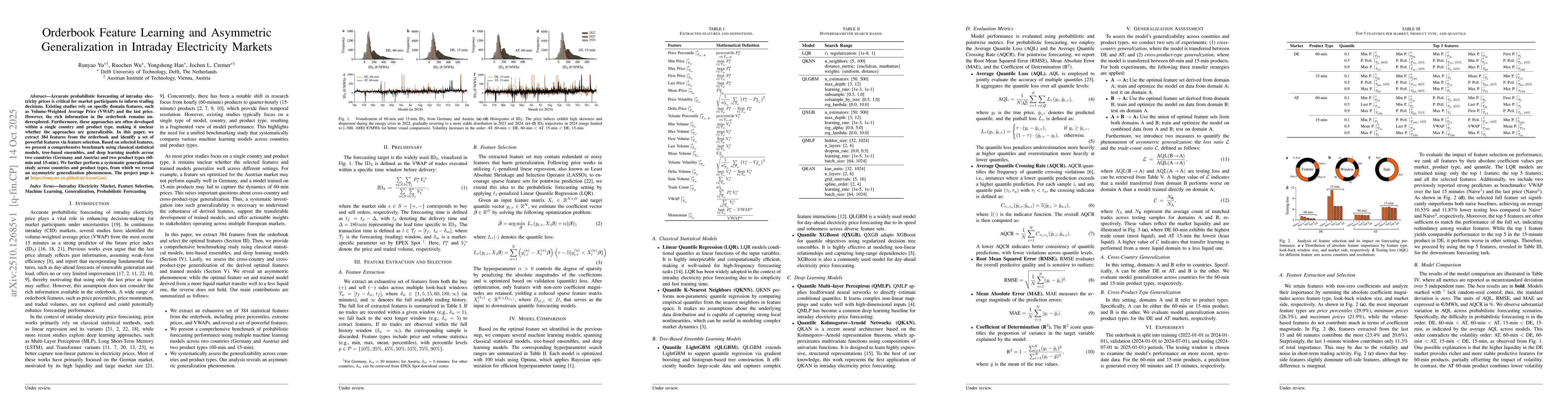

Accurate probabilistic forecasting of intraday electricity prices is critical for market participants to inform trading decisions. Existing studies rely on specific domain features, such as Volume-Weighted Average Price (VWAP) and the last price. However, the rich information in the orderbook remains underexplored. Furthermore, these approaches are often developed within a single country and product type, making it unclear whether the approaches are generalizable. In this paper, we extract 384 features from the orderbook and identify a set of powerful features via feature selection. Based on selected features, we present a comprehensive benchmark using classical statistical models, tree-based ensembles, and deep learning models across two countries (Germany and Austria) and two product types (60-min and 15-min). We further perform a systematic generalization study across countries and product types, from which we reveal an asymmetric generalization phenomenon.

AI Key Findings

Generated Oct 30, 2025

Methodology

The study employs a comprehensive feature set of 384 orderbook features to analyze intraday electricity price forecasting. It combines classical statistical models with deep learning approaches, using probabilistic quantile regression and neural networks for forecasting.

Key Results

- Deep learning models consistently outperform classical statistical models and tree-based ensembles

- Price percentiles and extreme prices outperform traditional features like VWAP and last price

- Asymmetric generalization is observed: models trained on liquid markets show better transferability to less liquid domains

Significance

This research advances probabilistic intraday electricity price forecasting by introducing novel features and demonstrating the superiority of deep learning approaches. The findings highlight the critical role of market liquidity in model performance, with implications for energy market design and risk management.

Technical Contribution

Development of a comprehensive 384-feature orderbook dataset and demonstration of its superiority over traditional features in probabilistic forecasting

Novelty

Integration of probabilistic quantile regression with deep learning models using domain-specific orderbook features, revealing the asymmetric generalization phenomenon related to market liquidity

Limitations

- Features are empirically derived and could benefit from broader exploration

- Hyperparameters are empirically tuned with potential for further optimization

Future Work

- Exploring more comprehensive feature sets for improved forecasting

- Investigating the sufficiency of simpler indicators like last price in more efficient markets

- Extending analysis to Nordic electricity markets

Paper Details

PDF Preview

Similar Papers

Found 5 papersA Machine Learning Approach for Prosumer Management in Intraday Electricity Markets

Mohammad Reza Hesamzadeh, Saeed Mohammadi

OrderFusion: Encoding Orderbook for Probabilistic Intraday Price Prediction

Jochen L. Cremer, Yuchen Tao, Runyao Yu et al.

Comments (0)