Authors

Summary

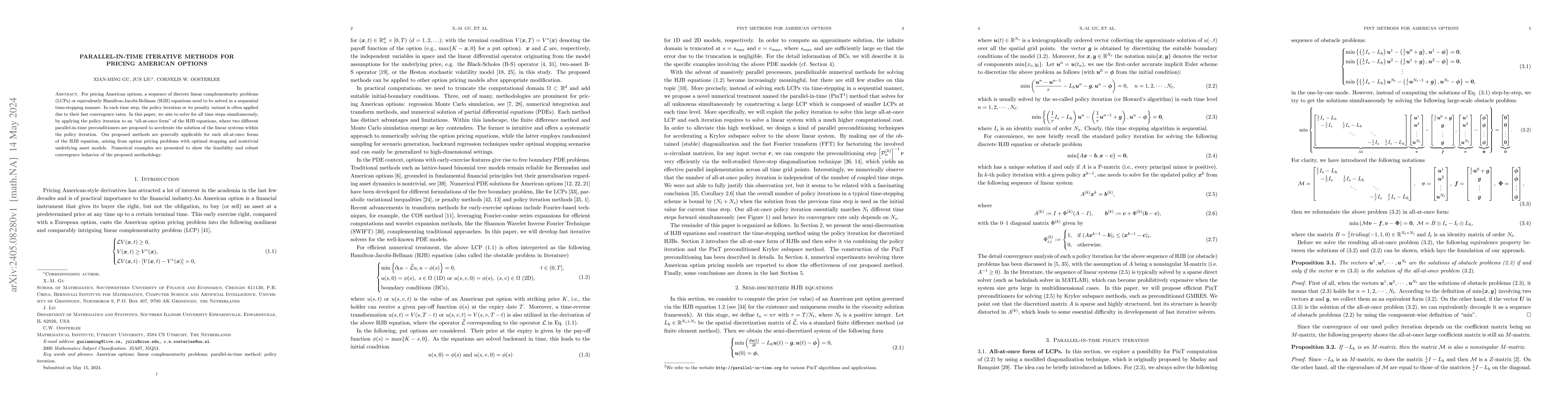

For pricing American options, %after suitable discretization in space and time, a sequence of discrete linear complementarity problems (LCPs) or equivalently Hamilton-Jacobi-Bellman (HJB) equations need to be solved in a sequential time-stepping manner. In each time step, the policy iteration or its penalty variant is often applied due to their fast convergence rates. In this paper, we aim to solve for all time steps simultaneously, by applying the policy iteration to an ``all-at-once form" of the HJB equations, where two different parallel-in-time preconditioners are proposed to accelerate the solution of the linear systems within the policy iteration. Our proposed methods are generally applicable for such all-at-once forms of the HJB equation, arising from option pricing problems with optimal stopping and nontrivial underlying asset models. Numerical examples are presented to show the feasibility and robust convergence behavior of the proposed methodology.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)