Authors

Summary

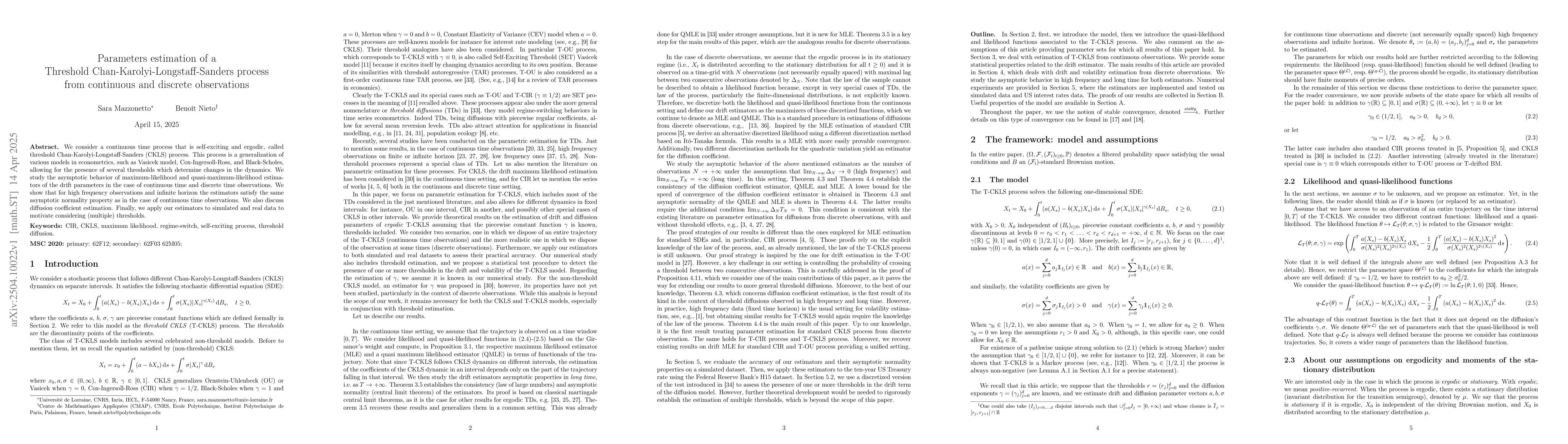

We consider a continuous time process that is self-exciting and ergodic, called threshold Chan-Karolyi-Longstaff-Sanders (CKLS) process. This process is a generalization of various models in econometrics, such as Vasicek model, Cox-Ingersoll-Ross, and Black-Scholes, allowing for the presence of several thresholds which determine changes in the dynamics. We study the asymptotic behavior of maximum-likelihood and quasi-maximum-likelihood estimators of the drift parameters in the case of continuous time and discrete time observations. We show that for high frequency observations and infinite horizon the estimators satisfy the same asymptotic normality property as in the case of continuous time observations. We also discuss diffusion coefficient estimation. Finally, we apply our estimators to simulated and real data to motivate considering (multiple) thresholds.

AI Key Findings

Generated Jun 09, 2025

Methodology

The paper employs a combination of theoretical analysis and simulation to study the asymptotic behavior of maximum-likelihood and quasi-maximum-likelihood estimators for a threshold Chan-Karolyi-Longstaff-Sanders process, considering both continuous and discrete time observations.

Key Results

- The estimators satisfy the same asymptotic normality property for high-frequency observations and infinite horizon, whether the observations are continuous or discrete.

- Consistency and asymptotic normality of estimators for drift parameters are established under specific hypotheses.

- Diffusion coefficient estimation is discussed, though detailed results are not provided in the abstract.

Significance

This research is significant for econometric modeling, particularly in the context of models like Vasicek, Cox-Ingersoll-Ross, and Black-Scholes, by allowing for multiple thresholds that determine changes in dynamics, thereby offering a more flexible framework.

Technical Contribution

The paper extends the theoretical framework for parameter estimation in ergodic, self-exciting processes with multiple thresholds, providing conditions for consistency and asymptotic normality of estimators under both continuous and discrete observation regimes.

Novelty

The introduction of a threshold Chan-Karolyi-Longstaff-Sanders process, which generalizes several existing models by incorporating multiple thresholds, represents a novel approach to modeling in econometrics.

Limitations

- The paper does not provide explicit conditions under which the asymptotic normality holds for discrete observations.

- Detailed proofs and technical aspects are deferred to appendices, which may limit immediate comprehensibility for non-specialist readers.

Future Work

- Further investigation into the specific conditions for asymptotic normality in the discrete observation case could be beneficial.

- Exploring applications of the proposed estimators to real financial data could validate the theoretical findings and demonstrate practical utility.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDrift estimation of the threshold Ornstein-Uhlenbeck process from continuous and discrete observations

Sara Mazzonetto, Paolo Pigato

No citations found for this paper.

Comments (0)