Summary

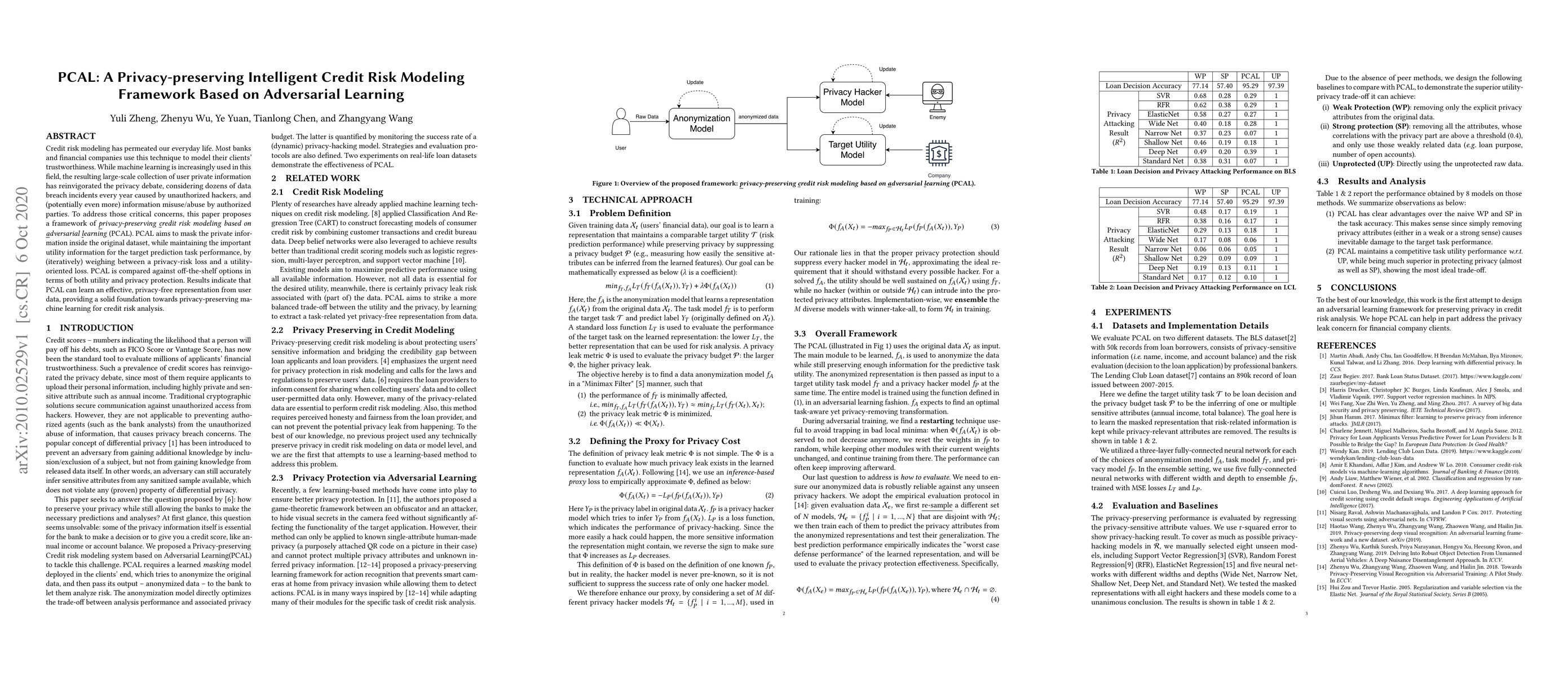

Credit risk modeling has permeated our everyday life. Most banks and financial companies use this technique to model their clients' trustworthiness. While machine learning is increasingly used in this field, the resulting large-scale collection of user private information has reinvigorated the privacy debate, considering dozens of data breach incidents every year caused by unauthorized hackers, and (potentially even more) information misuse/abuse by authorized parties. To address those critical concerns, this paper proposes a framework of Privacy-preserving Credit risk modeling based on Adversarial Learning (PCAL). PCAL aims to mask the private information inside the original dataset, while maintaining the important utility information for the target prediction task performance, by (iteratively) weighing between a privacy-risk loss and a utility-oriented loss. PCAL is compared against off-the-shelf options in terms of both utility and privacy protection. Results indicate that PCAL can learn an effective, privacy-free representation from user data, providing a solid foundation towards privacy-preserving machine learning for credit risk analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)