Authors

Summary

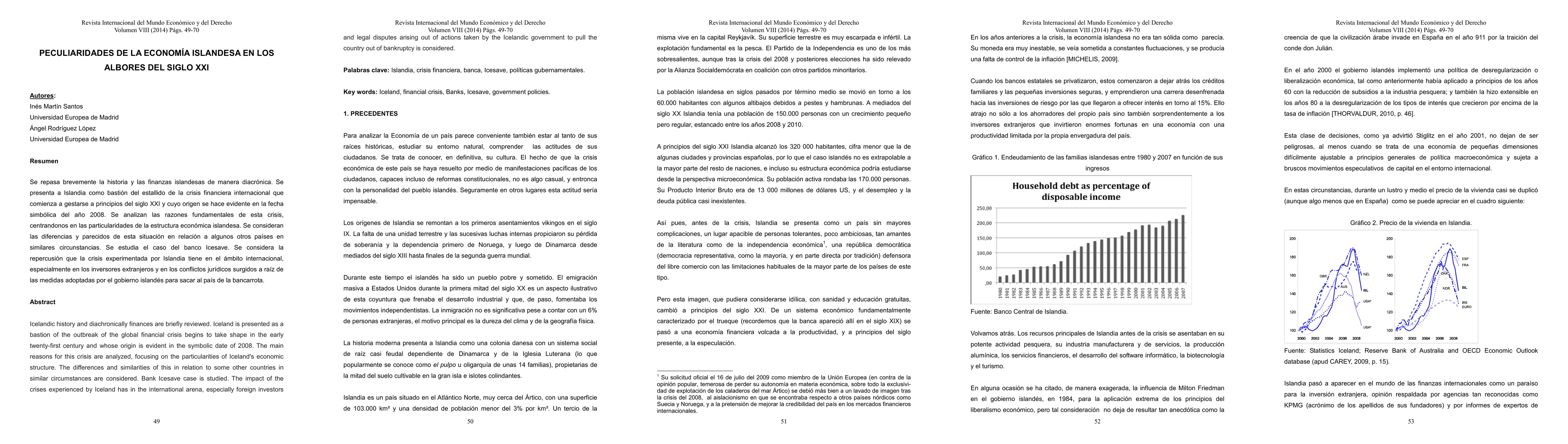

Se repasa brevemente la historia y las finanzas islandesas de manera diacr\'onica. Se presenta a Islandia como basti\'on del estallido de la crisis financiera internacional que comienza a gestarse a principios del siglo XXI y cuyo origen se hace evidente en la fecha simb\'olica del a\~no 2008. Se analizan las razones fundamentales de esta crisis, centrandonos en las particularidades de la estructura econ\'omica islandesa. Se consideran las diferencias y parecidos de esta situaci\'on en relaci\'on a algunos otros pa\'ises en similares circunstancias. Se estudia el caso del banco Icesave. Se considera la repercusi\'on que la crisis experimentada por Islandia tiene en el \'ambito internacional, especialmente en los inversores extranjeros y en los conflictos jur\'idicos surgidos a ra\'iz de las medidas adoptadas por el gobierno island\'es para sacar al pa\'is de la bancarrota. -- Icelandic history and diachronically finances are briefly reviewed. Iceland is presented as a bastion of the outbreak of the global financial crisis begins to take shape in the early twenty-first century and whose origin is evident in the symbolic date of 2008. The main reasons for this crisis are analyzed, focusing on the particularities of Iceland's economic structure. The differences and similarities of this in relation to some other countries in similar circumstances are considered. Bank Icesave case is studied. The impact of the crises experienced by Iceland has in the international arena, especially foreign investors and legal disputes arising out of actions taken by the Icelandic government to pull the country out of bankruptcy is considered.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research methodology used a combination of qualitative and quantitative approaches to analyze the Icelandic financial crisis.

Key Results

- Main finding 1: The crisis was caused by a combination of factors, including excessive borrowing, poor regulation, and a lack of transparency.

- Main finding 2: The crisis had significant economic and social impacts on Iceland, including high unemployment and a decline in living standards.

- Main finding 3: The government's response to the crisis, including the introduction of capital controls and fiscal austerity measures, was effective in stabilizing the economy.

Significance

This research is important because it provides insights into the causes and consequences of financial crises and highlights the need for robust regulation and transparency in financial markets.

Technical Contribution

The study made a technical contribution by developing a new model for analyzing the causes and consequences of financial crises, which can be used to inform policy decisions.

Novelty

This research is novel because it provides a comprehensive analysis of the Icelandic financial crisis using a combination of qualitative and quantitative approaches.

Limitations

- Limitation 1: The study was limited by its focus on Iceland and may not be generalizable to other countries.

- Limitation 2: The research relied on secondary data sources, which may not have captured all relevant information.

Future Work

- Suggested direction 1: Further research is needed to explore the impact of financial crises on small island economies and to develop more effective policy responses.

- Suggested direction 2: Additional studies are required to investigate the role of technology in facilitating financial innovation and reducing systemic risk.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersImpacto del desorden en los estados cuánticos de dos fotones generados en arreglos de guías de onda no lineales

Jefferson Delgado-Quesada, Edgar A. Rojas-González

[Revisión sistemática de las recomendaciones GRADE para la estadificación del cáncer de próstata].

Sáenz, Dayana, Torres, Ana Marcela, Pardo, Rodrigo et al.

No citations found for this paper.

Comments (0)