Summary

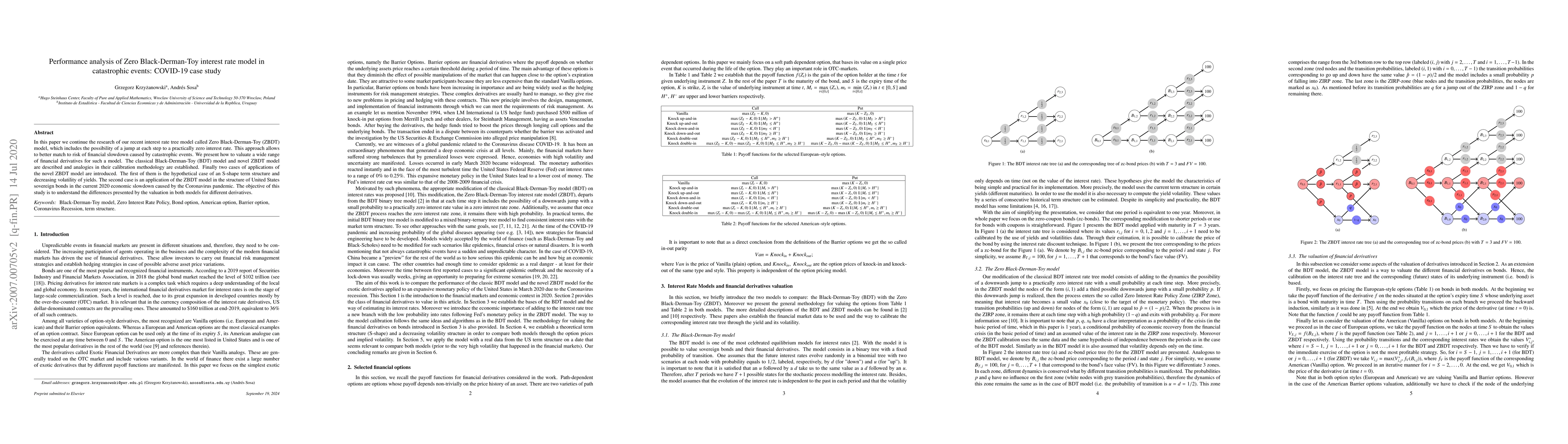

In this paper we continue the research of our recent interest rate tree model called Zero Black-Derman-Toy (ZBDT) model, which includes the possibility of a jump at each step to a practically zero interest rate. This approach allows to better match to risk of financial slowdown caused by catastrophic events. We present how to valuate a wide range of financial derivatives for such a model. The classical Black-Derman-Toy (BDT) model and novel ZBDT model are described and analogies in their calibration methodology are established. Finally two cases of applications of the novel ZBDT model are introduced. The first of them is the hypothetical case of an S-shape term structure and decreasing volatility of yields. The second case is an application of the ZBDT model in the structure of United States sovereign bonds in the current $2020$ economic slowdown caused by the Coronavirus pandemic. The objective of this study is to understand the differences presented by the valuation in both models for different derivatives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNon-parametric Bayesian mixture model to study adverse events of COVID-19 vaccines

Ali Turfah, Xiaoquan Wen, Lili Zhao

Background rates of medical events of interest before and during the COVID-19 pandemic: a longitudinal cohort study using claims data.

Shao, Ping, Popoola, Victor O, Keebler, Daniel et al.

No citations found for this paper.

Comments (0)