Authors

Summary

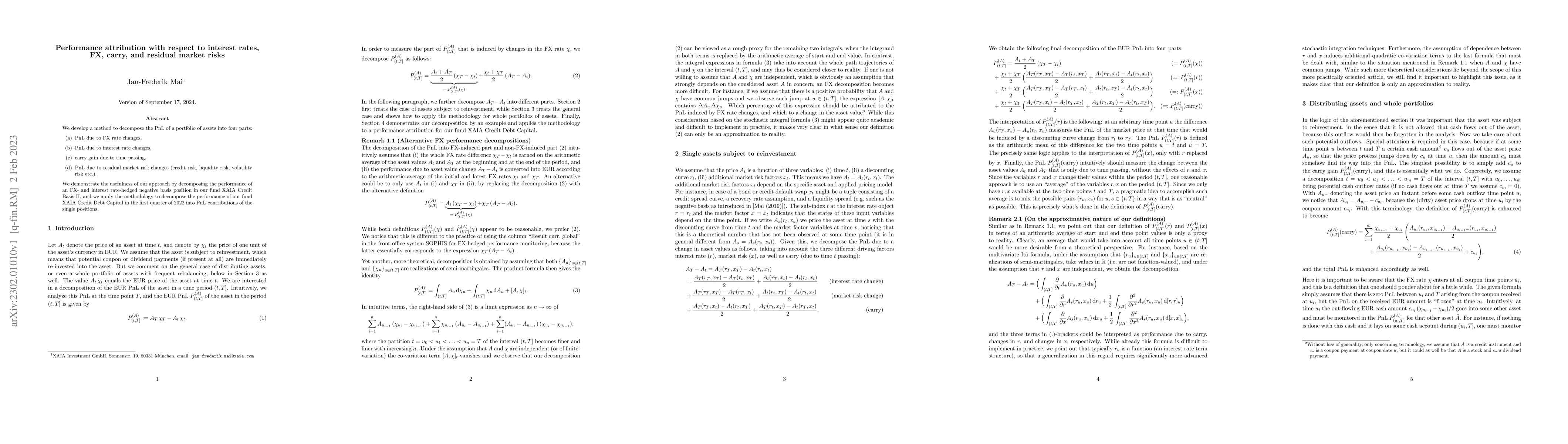

We develop a method to decompose the PnL of a portfolio of assets into four parts: (a) PnL due to FX rate changes, (b) PnL due to interest rate changes, (c) carry gain due to time passing, (d) PnL due to residual market risk changes (credit risk, liquidity risk, volatility risk etc.). We demonstrate the usefulness of our approach by decomposing the performance of an FX- and interest rate-hedged negative basis position in our fund XAIA Credit Basis II, and we apply the methodology to decompose the performance of our fund XAIA Credit Debt Capital in the first quarter of 2022 into PnL contributions of the single positions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)