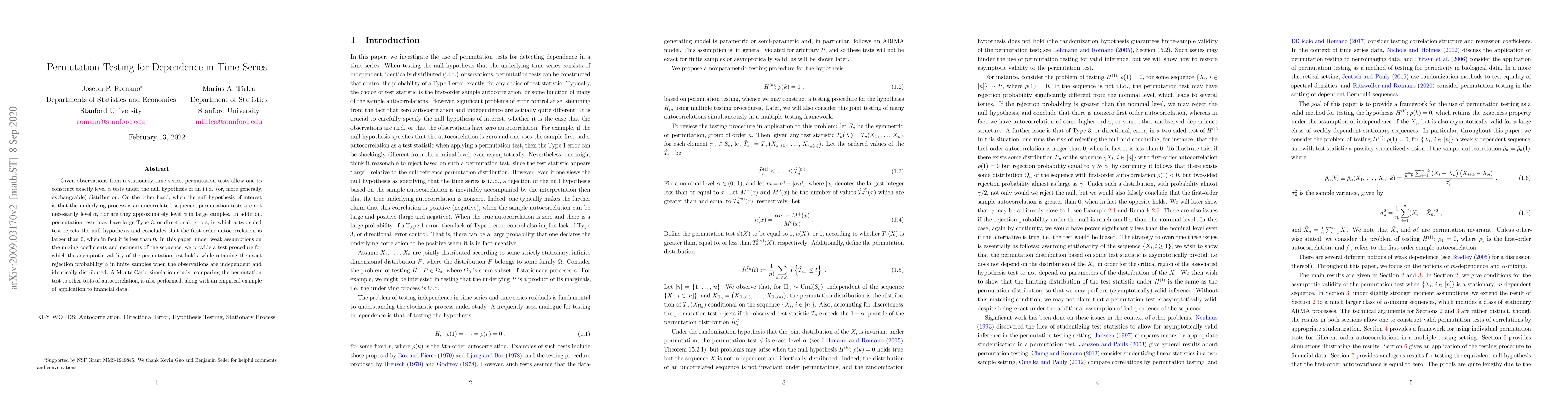

Summary

Given observations from a stationary time series, permutation tests allow one to construct exactly level $\alpha$ tests under the null hypothesis of an i.i.d. (or, more generally, exchangeable) distribution. On the other hand, when the null hypothesis of interest is that the underlying process is an uncorrelated sequence, permutation tests are not necessarily level $\alpha$, nor are they approximately level $\alpha$ in large samples. In addition, permutation tests may have large Type 3, or directional, errors, in which a two-sided test rejects the null hypothesis and concludes that the first-order autocorrelation is larger than 0, when in fact it is less than 0. In this paper, under weak assumptions on the mixing coefficients and moments of the sequence, we provide a test procedure for which the asymptotic validity of the permutation test holds, while retaining the exact rejection probability $\alpha$ in finite samples when the observations are independent and identically distributed. A Monte Carlo simulation study, comparing the permutation test to other tests of autocorrelation, is also performed, along with an empirical example of application to financial data.

AI Key Findings

Generated Sep 07, 2025

Methodology

The paper develops a permutation testing framework for dependence in time series, specifically focusing on the first-order autocorrelation. It provides a test procedure ensuring asymptotic validity of the permutation test while maintaining exact rejection probability $\alpha$ in finite samples under the null hypothesis of an i.i.d. distribution.

Key Results

- The paper shows that standard permutation tests for dependence in time series may not maintain level $\alpha$ even in large samples.

- A new test procedure is proposed that ensures asymptotic validity while preserving exact rejection probability $\alpha$ in finite samples when observations are i.i.d.

- The proposed test is demonstrated to have smaller Type 3 errors compared to standard permutation tests.

Significance

This research is significant as it addresses the limitations of standard permutation tests for time series data, providing a more reliable method for testing dependence under weak assumptions on mixing coefficients and moments.

Technical Contribution

The paper introduces a novel permutation testing procedure for dependence in time series, ensuring asymptotic validity and exact level $\alpha$ under the null hypothesis of i.i.d. observations.

Novelty

This work differs from existing research by providing a permutation test for dependence in time series that maintains exact level $\alpha$ in finite samples and reduces Type 3 errors, which are common issues with standard permutation tests.

Limitations

- The proposed method relies on weak assumptions about mixing coefficients and moments of the sequence.

- The practical application of the method may depend on the specific characteristics of the time series data.

Future Work

- Further investigation into the performance of the proposed test for different types of time series data.

- Exploration of extensions to higher-order autocorrelations or more general dependence structures.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLeast Squares-Based Permutation Tests in Time Series

Joseph P. Romano, Marius A. Tirlea

Permutation extropy: a time series complexity measure

Suchandan Kayal, Ritik Roshan Giri

| Title | Authors | Year | Actions |

|---|

Comments (0)