Summary

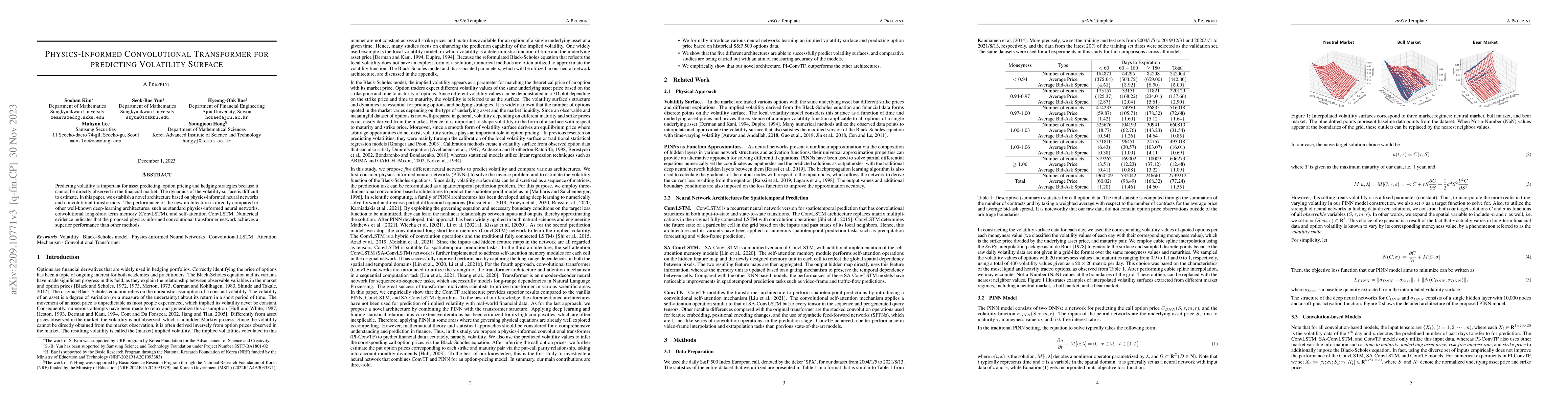

Predicting volatility is important for asset predicting, option pricing and hedging strategies because it cannot be directly observed in the financial market. The Black-Scholes option pricing model is one of the most widely used models by market participants. Notwithstanding, the Black-Scholes model is based on heavily criticized theoretical premises, one of which is the constant volatility assumption. The dynamics of the volatility surface is difficult to estimate. In this paper, we establish a novel architecture based on physics-informed neural networks and convolutional transformers. The performance of the new architecture is directly compared to other well-known deep-learning architectures, such as standard physics-informed neural networks, convolutional long-short term memory (ConvLSTM), and self-attention ConvLSTM. Numerical evidence indicates that the proposed physics-informed convolutional transformer network achieves a superior performance than other methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWhack-a-mole Online Learning: Physics-Informed Neural Network for Intraday Implied Volatility Surface

Paolo Barucca, Kentaro Hoshisashi, Carolyn E. Phelan

An effective physics-informed neural operator framework for predicting wavefields

Xiao Ma, Tariq Alkhalifah

Physics-informed Deep Learning for Musculoskeletal Modelling: Predicting Muscle Forces and Joint Kinematics from Surface EMG

Jie Zhang, Zhiqiang Zhang, Alejandro F. Frangi et al.

Physics Informed Token Transformer for Solving Partial Differential Equations

Amir Barati Farimani, Cooper Lorsung, Zijie Li

| Title | Authors | Year | Actions |

|---|

Comments (0)