Authors

Summary

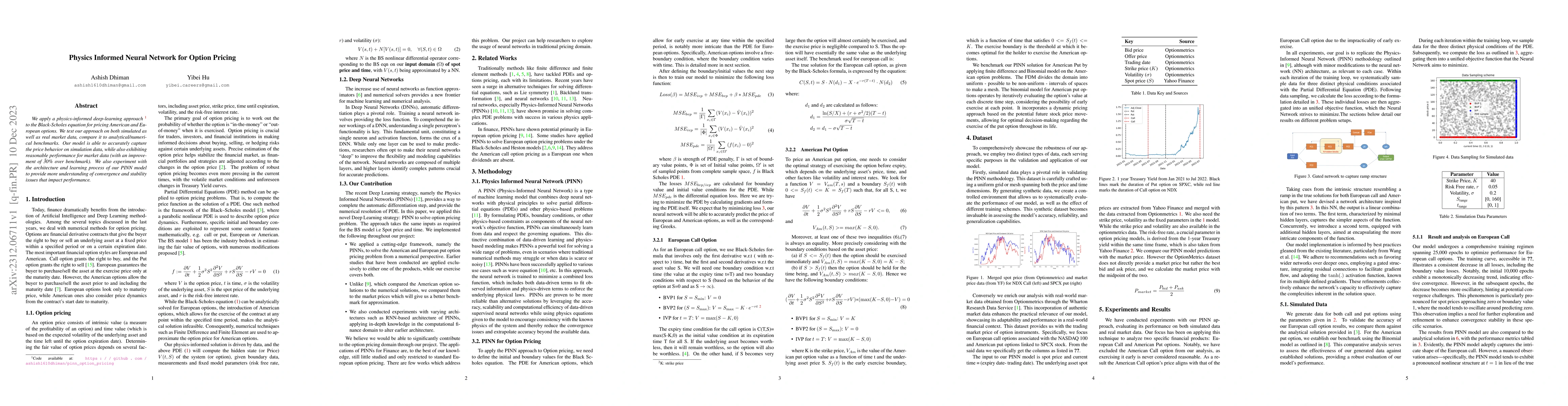

We apply a physics-informed deep-learning approach the PINN approach to the Black-Scholes equation for pricing American and European options. We test our approach on both simulated as well as real market data, compare it to analytical/numerical benchmarks. Our model is able to accurately capture the price behaviour on simulation data, while also exhibiting reasonable performance for market data. We also experiment with the architecture and learning process of our PINN model to provide more understanding of convergence and stability issues that impact performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAdaptive Movement Sampling Physics-Informed Residual Network (AM-PIRN) for Solving Nonlinear Option Pricing models

Ran Zhang, Qinjiao Gao, Zuowei Wang et al.

Neural Network Learning of Black-Scholes Equation for Option Pricing

Daniel de Souza Santos, Tiago Alessandro Espinola Ferreira

Jump Diffusion-Informed Neural Networks with Transfer Learning for Accurate American Option Pricing under Data Scarcity

Yuwei Zhang, Qiguo Sun, Hanyue Huang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)