Summary

We study the behavior of an economic platform (e.g., Amazon, Uber Eats, Instacart) under shocks, such as COVID-19 lockdowns, and the effect of different regulation considerations imposed on a platform. To this end, we develop a multi-agent Gym environment of a platform economy in a dynamic, multi-period setting, with the possible occurrence of economic shocks. Buyers and sellers are modeled as economically-motivated agents, choosing whether or not to pay corresponding fees to use the platform. We formulate the platform's problem as a partially observable Markov decision process, and use deep reinforcement learning to model its fee setting and matching behavior. We consider two major types of regulation frameworks: (1) taxation policies and (2) platform fee restrictions, and offer extensive simulated experiments to characterize regulatory tradeoffs under optimal platform responses. Our results show that while many interventions are ineffective with a sophisticated platform actor, we identify a particular kind of regulation -- fixing fees to optimal, pre-shock fees while still allowing a platform to choose how to match buyer demands to sellers -- as promoting the efficiency, seller diversity, and resilience of the overall economic system.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

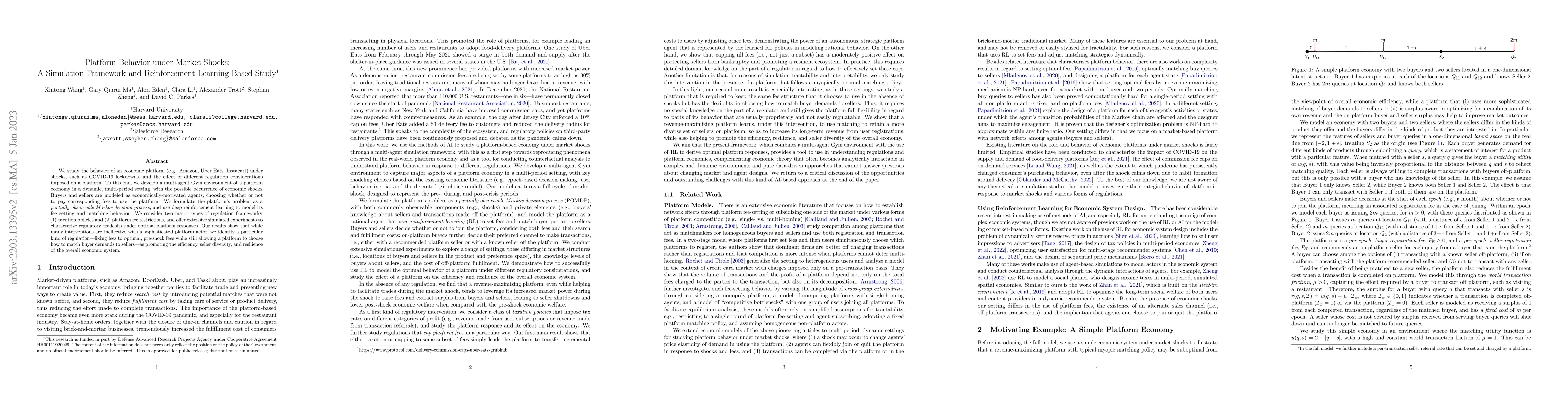

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReinforcement Learning in Agent-Based Market Simulation: Unveiling Realistic Stylized Facts and Behavior

Zheng Li, Zhiyuan Yao, Matthew Thomas et al.

Deep Reinforcement Learning for Market Making Under a Hawkes Process-Based Limit Order Book Model

Zvonko Kostanjčar, Bruno Gašperov

| Title | Authors | Year | Actions |

|---|

Comments (0)