Authors

Summary

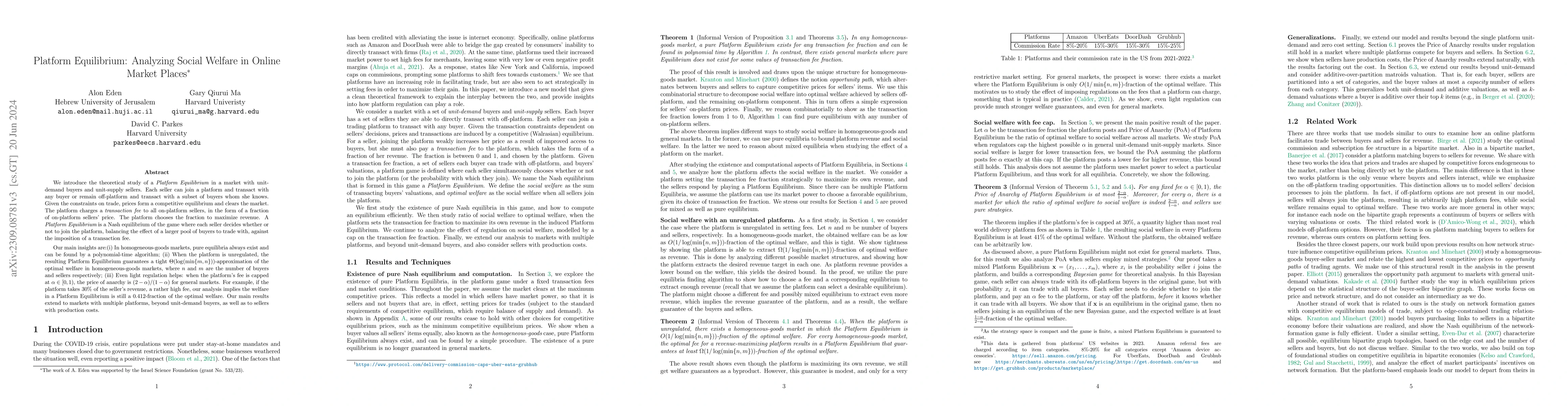

We introduce the theoretical study of a Platform Equilibrium in a market with unit-demand buyers and unit-supply sellers. Each seller can join a platform and transact with any buyer or remain off-platform and transact with a subset of buyers whom she knows. Given the constraints on trade, prices form a competitive equilibrium and clears the market. The platform charges a transaction fee to all on-platform sellers, in the form of a fraction of on-platform sellers' price. The platform chooses the fraction to maximize revenue. A Platform Equilibrium is a Nash equilibrium of the game where each seller decides whether or not to join the platform, balancing the effect of a larger pool of buyers to trade with, against the imposition of a transaction fee. Our main insights are: (i) In homogeneous-goods markets, pure equilibria always exist and can be found by a polynomial-time algorithm; (ii) When the platform is unregulated, the resulting Platform Equilibrium guarantees a tight $\Theta(log(min(m, n)))$-approximation of the optimal welfare in homogeneous-goods markets, where $n$ and $m$ are the number of buyers and sellers respectively; (iii) Even light regulation helps: when the platform's fee is capped at $\alpha\in[0,1)$, the price of anarchy is 2-$\alpha$/1-$\alpha$ for general markets. For example, if the platform takes 30 percent of the seller's revenue, a rather high fee, our analysis implies the welfare in a Platform Equilibrium is still a 0.412-fraction of the optimal welfare. Our main results extend to markets with multiple platforms, beyond unit-demand buyers, as well as to sellers with production costs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConstant Function Market Making, Social Welfare and Maximal Extractable Value

Bruno Mazorra, Nicolás Della Penna

| Title | Authors | Year | Actions |

|---|

Comments (0)