Authors

Summary

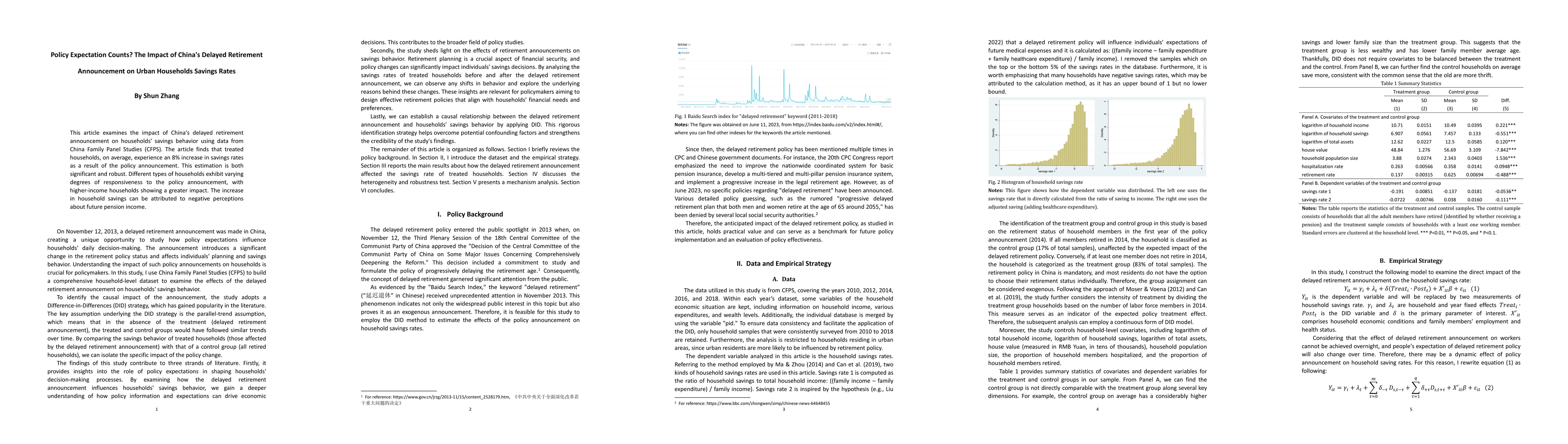

This article examines the impact of China's delayed retirement announcement on households' savings behavior using data from China Family Panel Studies (CFPS). The article finds that treated households, on average, experience an 8% increase in savings rates as a result of the policy announcement. This estimation is both significant and robust. Different types of households exhibit varying degrees of responsiveness to the policy announcement, with higher-income households showing a greater impact. The increase in household savings can be attributed to negative perceptions about future pension income.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImpact of the Three-Child Policy and Delayed Retirement on the Transfer of Surplus Rural Labor under Xi Jinping's New Population Vision: A Re-examination of China's Lewis Turning Point

Jun Dai, Xiaoke Xie, Guanqing Shi et al.

Changes in Retirement Savings During the COVID Pandemic

Elena Derby, Lucas Goodman, Kathleen Mackie et al.

Empirical Analysis of the Impact of Legal Tender Digital Currency on Monetary Policy -Based on China's Data

Chunhui Zhou, Ruimin Song, TIntian Zhao

No citations found for this paper.

Comments (0)