Summary

The aim of the present paper is to provide criteria for a central bank of how to choose among different monetary-policy rules when caring about a number of policy targets such as the output gap and expected inflation. Special attention is given to the question if policy instruments are predetermined or only forward looking. Using the new-Keynesian Phillips curve with a cost-push-shock policy-transmission mechanism, the forward-looking case implies an extreme lack of robustness and of credibility of stabilization policy. The backward-looking case is such that the simple-rule parameters can be the solution of Ramsey optimal policy under limited commitment. As a consequence, we suggest to model explicitly the rational behavior of the policy maker with Ramsey optimal policy, rather than to use simple rules with an ambiguous assumption leading to policy advice that is neither robust nor credible.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

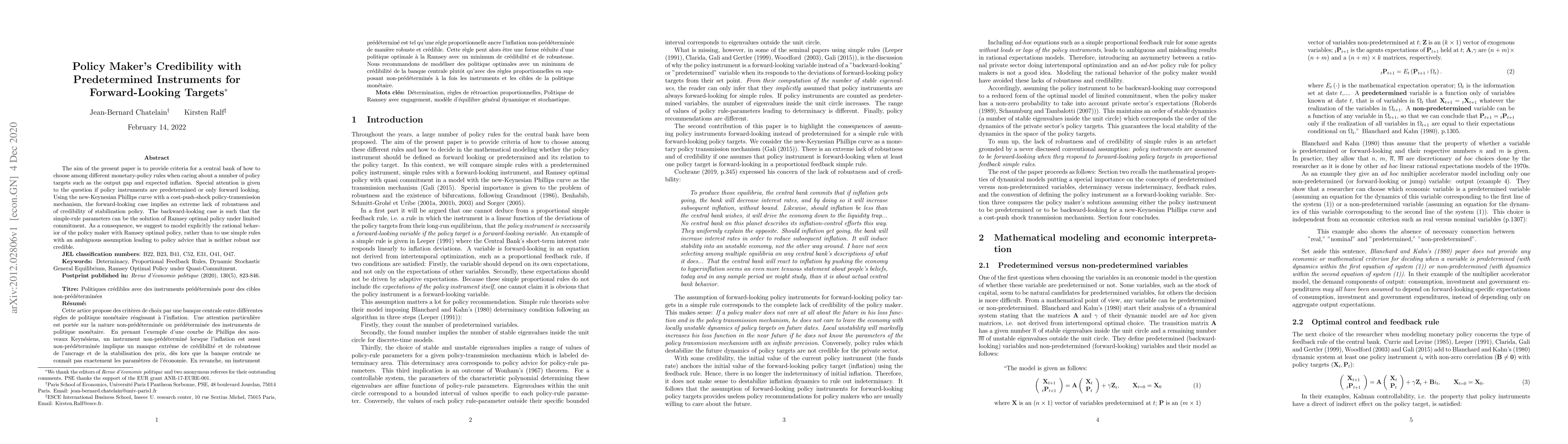

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSwitchback Price Experiments with Forward-Looking Demand

Yifan Wu, Ramesh Johari, Vasilis Syrgkanis et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)