Summary

We consider an investor who seeks to maximize her expected utility derived from her terminal wealth relative to the maximum performance achieved over a fixed time horizon, and under a portfolio drawdown constraint, in a market with local stochastic volatility (LSV). In the absence of closed-form formulas for the value function and optimal portfolio strategy, we obtain approximations for these quantities through the use of a coefficient expansion technique and nonlinear transformations. We utilize regularity properties of the risk tolerance function to numerically compute the estimates for our approximations. In order to achieve similar value functions, we illustrate that, compared to a constant volatility model, the investor must deploy a quite different portfolio strategy which depends on the current level of volatility in the stochastic volatility model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

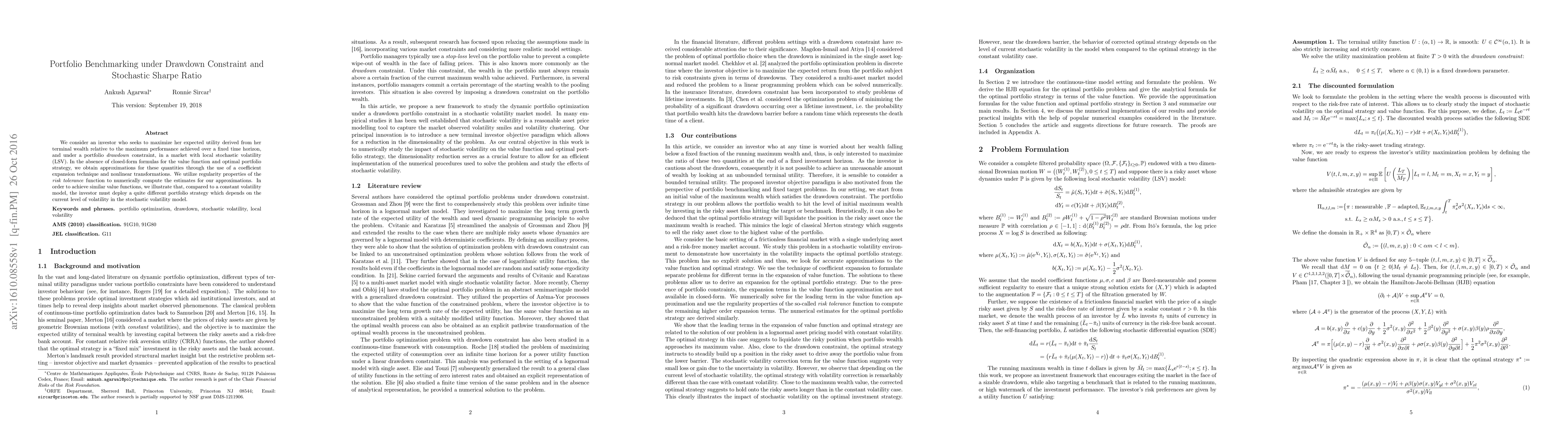

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Globally Optimal Portfolio for m-Sparse Sharpe Ratio Maximization

Cheng Li, Zhao-Rong Lai, Yizun Lin

| Title | Authors | Year | Actions |

|---|

Comments (0)