Summary

We investigate an application of network centrality measures to portfolio optimization, by generalizing the method in [Pozzi, Di Matteo and Aste, \emph{Spread of risks across financial markets: better to invest in the peripheries}, Scientific Reports 3:1665, 2013], that however had significant limitations with respect to the state of the art in network theory. In this paper, we systematically compare many possible variants of the originally proposed method on S\&P 500 stocks. We use daily data from twenty-seven years as training set and their following year as test set. We thus select the best network-based methods according to different viewpoints including for instance the highest Sharpe Ratio and the highest expected return. We give emphasis in new centrality measures and we also conduct a thorough analysis, which reveals significantly stronger results compared to those with more traditional methods. According to our analysis, this graph-theoretical approach to investment can be used successfully by investors with different investment profiles leading to high risk-adjusted returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

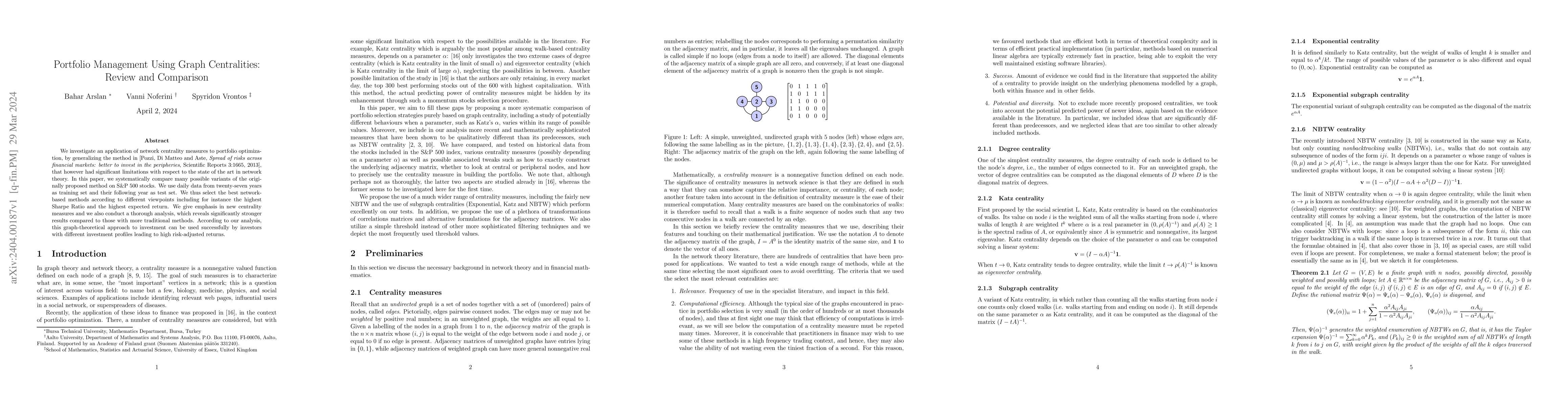

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUsing Causality-Aware Graph Neural Networks to Predict Temporal Centralities in Dynamic Graphs

Ingo Scholtes, Franziska Heeg

Portfolio Management using Deep Reinforcement Learning

Ashish Anil Pawar, Vishnureddy Prashant Muskawar, Ritesh Tiku

| Title | Authors | Year | Actions |

|---|

Comments (0)