Authors

Summary

This paper introduces a unified framework for adaptive portfolio management, integrating dynamic Black-Litterman (BL) optimization with the general factor model, Elastic Net regression, and mean-variance portfolio optimization, which allows us to generate investors views and mitigate potential estimation errors systematically. Specifically, we propose an innovative dynamic sliding window algorithm to respond to the constantly changing market conditions. This algorithm allows for the flexible window size adjustment based on market volatility, generating robust estimates for factor modeling, time-varying BL estimations, and optimal portfolio weights. Through extensive ten-year empirical studies using the top 100 capitalized assets in the S&P 500 index, accounting for turnover transaction costs, we demonstrate that this combined approach leads to computational advantages and promising trading performances.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

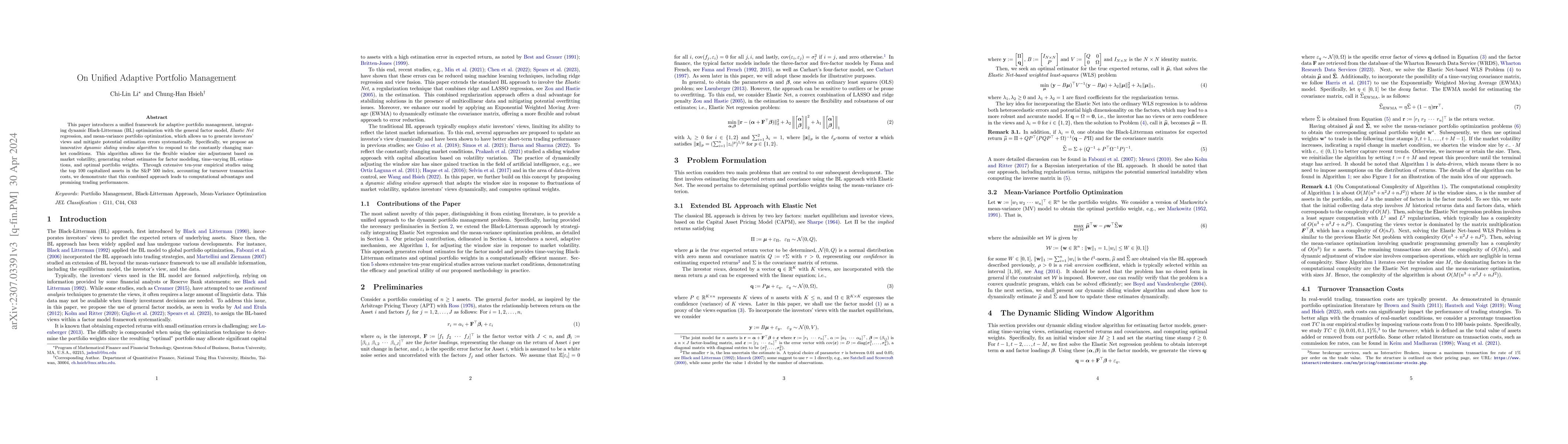

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket-Adaptive Ratio for Portfolio Management

Ju-Hong Lee, Bayartsetseg Kalina, KwangTek Na

Adaptive Predictive Portfolio Management Agent

Anton Kolonin, Alexey Glushchenko, Arseniy Fokin et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)